November 2019

Jasmine Vattathara

Areas of Expertise Expatriates Inpatriates International organization employees and retirees High net worth individuals with foreign interests Certifications/Credentials CPA, Licensed in Virginia Education Bachelor of Commerce, Accounting & Business, University of Delhi, India Cost and Works Accountant from Institute of Cost and Works Accountants of India (ICWAI) Languages Spoken English Hindi Punjabi Urdu Senior Tax Specialist Jasmine is a CPA and Senior Tax Specialist responsible for providing specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees, and entrepreneurs with foreign interests. In this capacity, Jasmine assists U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. Before joining TWG, Jasmine worked as a Tax Analyst in the corporate tax department of a large U.S. government contractor, where she was responsible for conducting tax due diligence and ensuring corporate tax compliance. Previously, she spent four years with a Northern Virginia CPA firm, preparing U.S. individual, corporate, and partnership tax returns. Outside of work, Jasmine is a decorating enthusiast and likes to visit art galleries around the country.

Fan Chen

Areas of Expertise IRS Amnesty Programs (Streamlined & OVDP) US citizens living overseas US nonresidents Foreign asset reporting EB-5 investors Certifications/Credentials CPA, licensed in Virginia Education Master’s of Accounting, American University BS, Business Administration–Accounting & Finance, American University Languages Spoken English Mandarin Senior Tax Manager Fan is a CPA and Senior Tax Manager at The Wolf Group, with seven years of experience in the tax and accounting industry. A member of The Wolf Group team since 2015, Fan provides specialized U.S. tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees, and entrepreneurs with foreign interests. In her day-to-day practice, Fan provides advice and assistance to Individuals with complex, cross-border situations, including U.S. citizens, green card holders, international organization employees, various visa holders, and U.S. nonresidents Companies with globally mobile staff Individuals coming into U.S. tax compliance via IRS amnesty programs (Offshore Voluntary Disclosure and Streamlined Programs) Individuals relinquishing their U.S. citizenship or green cards Individuals who have received tax notices and audits from the IRS or state taxing authorities Before joining The Wolf Group in 2015, Fan worked at a US “Big 4” accounting firm, preparing individual, corporate, and expatriate tax returns. Outside of work, Fan loves listening to music, going to concerts, traveling, and snowboarding in the winter.

Kristin Coulter

Areas of Expertise International organization employees and retirees US nonresidents Certifications/Credentials CPA Education BBA, focus in Accounting, The College of William and Mary Languages Spoken English Tax Manager Kristin is a CPA and Tax Manager, she provides senior technical tax advice and assistance to long-term clients; supports international employees and retirees (US citizens, green card holders, and G-4 visa holders) with ties to The World Bank, IMF, IDB, and other international organizations; and prepares and reviews a variety of individual tax returns. In her role at The Wolf Group, Kristin helps US citizens, green card holders, and foreign nationals in understanding their options and needs. She provides specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as entrepreneurs with foreign interests. Prior to joining The Wolf Group in 2009, Kristin worked as a tax manager at KPMG and as a seasonal tax specialist for a local CPA firm. In her free time, Kristin enjoys travel, reading, hiking, and yoga.

Lori Compton

Areas of Expertise High-net-worth individuals International organization employees US citizens living abroad US nonresidents Certifications/Credentials CPA, licensed in Virginia and Pennsylvania Education Bachelor of Science, Accounting, Wilkes College, Wilkes Barre, PA Languages Spoken English Senior Tax Manager Lori is a CPA and Tax Senior Manager, with 30 years of experience in individual, corporate, and partnership taxation, including 25 years of experience in international taxation. Lori has broad and deep knowledge in serving expatriate and international organization populations, as well as high-net-worth clients and entrepreneurs with foreign interests. A 25-year veteran of The Wolf Group, she has: Worked with hundreds of U.S. citizens, green card holders, and G-4 visa holders with ties to the World Bank, IMF, IDB, and various other international organizations Provided quality assurance reviews for many of the firm’s most complex tax returns with foreign income and asset reporting Supported global mobility clients with a range of assignee population sizes and needs Worked with business owners to advise them on accounting matters, guide their tax planning, and complete their partnership and corporate tax returns Assisted new clients with their IRS Amnesty filings under every Offshore Voluntary Disclosure and Streamlined Program available since the programs were launched in 2009 Lori plays a significant role in maintaining a high level of international tax knowledge and quality within the firm. She provides guidance, training, and oversight to tax technical team members. Before joining The Wolf Group in 1995, Lori worked for a large regional CPA firm as a Senior Accountant and for a government contractor in its accounting department. In her free time, Lori enjoys vacations at the beach, working out at the gym, and gardening.

Elizabeth Capriles

Areas of Expertise Accounts payable, accounts receivables, financial statements, payroll, bank reconciliations Computerized accounting Tax preparation Certifications/Credentials Accountant Education Universidad Privada Boliviana Tax Preparation at HR Block and other trainings related to taxes Languages Spoken English Spanish Accounting Manager Elizabeth oversees the preparation of The Wolf Group’s financial statements, accounts receivables, accounts payables, payroll, inventory, bank reconciliations, preparation of W-2/3 forms for domestic employers, and the preparation of 1099 misc/1096 forms. In this capacity, Elizabeth works with the employees of The Wolf Group and Wolf Group Capital Advisors. She also assists clients with billing inquiries. Before she came to The Wolf Group, Elizabeth worked in the accounting department at Metrocall. She also worked as administrator/accountant for more than 10 years in Bolivia. Outside of work, Elizabeth enjoys time with family, reading, walking, going to the gym, and playing Rammikub with friends.

Han Niu

Areas of Expertise Expatriates International Entities Certifications/Credentials CPA, licensed in New York Education Master of Taxation, St. John’s University New York Bachelor of Accounting, St. John’s University New York Languages Spoken Chinese English Tax Specialist Han is a CPA and Tax Specialist responsible for providing specialized tax services to clients with international concerns including expatriates, inpatriates, and high-net-worth individuals with global assets, and entrepreneurs with foreign interests. In addition, she has helped clients come back into US tax compliance under IRS Amnesty Programs, such as the Offshore Voluntary Disclosure Program and Streamlined Programs. In her role, she works with expatriates and other international persons and entities. Before joining The Wolf Group, Han worked as a tax consultant at a CPA firm specializing in international individual tax. Outside of work, Han enjoys biking.

Margaret Harmon

Areas of Expertise International Foreign asset reporting—FBAR, Form 8938, Form 8621 International Foreign Partnerships and Corporations-Forms 5471 and 8865 Expatriate Tax Returns—Form 2555s and 1116. OVDP streamline reporting—Foreign and Domestic Streamline programs Certifications/Credentials CPA Education Bachelor’s Degree, Accounting, George Mason University Languages Spoken English Senior Tax Specialist Margaret is a CPA and Senior Tax Specialist, working on complex international tax issues. She has over 30 years of experience in tax, audit, and accounting. Margaret provides US tax service to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees, and entrepreneurs with foreign interests. In this role, Margaret helps tax clients in the preparation of their tax returns to ensure they receive the most tax advantageous approaches for their specific tax situation. Prior to joining The Wolf Group, Margaret worked in the tax field for 20 years. She was a senior tax preparer at several other CPA firms. She also has a background in auditing and worked for the Defense Contract Audit Agency and the Environmental Protection Agency in that capacity. Outside of work, Margaret enjoys going to bootcamp exercise classes, attending her kids’ sporting events, attending 80s concerts, and watching reality TV shows.

Angela Eichenbrenner

Areas of Expertise Expatriates Inpatriates International organization employees and retirees Entrepreneurs with foreign interests Education Bachelor’s Degree, cum laude, Virginia Tech and Old Dominion University Languages Spoken English Senior Tax Specialist Angela is a seasonal Senior Tax Specialist at The Wolf Group, with more than 25 years of experience preparing individual and fiduciary returns. Since joining The Wolf Group in 2012, she has provided specialized US tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees, and entrepreneurs with foreign interests. In this capacity, Angela assists U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. She also works closely with attorneys and other experts to support clients participating in the IRS’s Offshore Voluntary Disclosure Programs.

Diane Cammas

Areas of Expertise Human resources Recruiting Certifications/Credentials SHRM Certified Education Bachelor’s Degree, Marketing, George Mason University Languages Spoken English Chief Operating Officer Bio Coming Soon!

Angeles Rios

Areas of Expertise Tax return processing Client and project records Administrative support Client service Languages English Spanish Senior Tax Processor As a member of The Wolf Group, Angeles provides administrative, office, and client assistance in support of the firm’s operations. Throughout the year, she serves as the main tax processor for our clients’ tax returns. This involves taking the final returns prepared by the tax team and getting them ready for delivery to clients, including dividing them into their component pieces, ensuring that files are clearly labeled and filing instructions are included, attaching all necessary tax support documents, and delivering the returns to clients via secure, encrypted means (or via mail or FedEx). In addition, Angeles assists in the onboarding of new clients, setting them up properly in the firm’s software and systems, as well as with other support for the firm’s day-to day-operations. Outside of work, Angeles likes to be out in nature and take walks. She enjoys traveling, seeing new places, and experiencing new things.

Kristie Valenzuela

Areas of Expertise Client Relations Database Management Education Associates Degree, Accounting Languages Spoken English Client Service Coordinator Kristie is often the first point of contact for clients, taking new client calls and coordinating discovery meetings or consultations. She assembles and sends customized tax packages to new and prospective tax clients and creates and maintains their office records. In this capacity, Kristie works with all The Wolf Group’s clients—prospective, new, and current. She is part of the administrative team, with a wide variety of duties that help keep The Wolf Group organized and running efficiently. Prior to joining The Wolf Group, Kristie was a commercial loan analyst and commercial loan processor for Pioneer Bank in El Paso, Texas and for LendingXpress in Irvine, California. Outside of work, Kristie enjoys spending time with her family and going to the movies.

Global tax leaders share ideas to fight cryptocurrency tax crimes and cybercrimes.

Participants from the five countries comprising the Joint Chiefs of Global Tax Enforcement (J5)—the United States, the United Kingdom, Canada, the Netherlands, and Australia—spend the week of November 4 in Los Angeles collaborating on ways to fight cryptocurrency tax crimes and cybercrimes.

October 2019

G4 Visa Holders and US Tax Residency Issues

Many G4 visa holders are confused over their US tax residency status. They have heard that merely holding a G4 visa entitles the holder to be a non-resident. But this is not true. The US income tax code and regulations don’t even mention “G4 visas.” Then why are most G4’s considered nonresidents? And more importantly, why does it matter? Nonresident vs. Resident Taxation and Why it Matters A foreign national (who is a non-US citizen) may be taxed under the US income tax system as either a resident or a non-resident. A non-resident is only taxable in the United States on US source income. This includes wages for work performed in the United States. It also includes US source investment income, such as dividends received from US corporations. This does not include wages earned by a G4 visa holder from an international organization. US tax residents are subject to US income tax on their worldwide income. Worldwide income includes earnings from all sources. Even income that is also taxed in another country. US tax residents must also report foreign financial assets that exceed certain thresholds on forms like the FBAR and Form 8938. Lastly, US tax residents may also have international informational reporting for any interests owned in foreign businesses and/or trusts. G4 Visa Holders and the “Substantial Presence Test” The general rule under the US tax code is that a foreign national who is present in the United States for 183 days or more in a calendar year becomes a US income tax resident under the so-called Substantial Presence Test (SPT). Also, if the person is present in the United States on at least 31 days of the current calendar year, he or she may be classified as a US tax resident if his/her days of US presence exceed 182 days using the following formula: An Exception to General Rule—“Exempt Individuals” A notable exception under the Substantial Presence Test of residency provides that any day that an individual is present in the US as an “exempt individual” is not counted as a day of US presence. An “exempt individual” includes a foreign national who is present in the US because of “his or her full-time employment with an international organization.” Also included are the immediate family of an exempt individual (spouse and unmarried children under 21 years of age). Therefore, while a G4 visa holder is employed and working on a full-time basis for an international organization, his/her days are not counted as US days, and the individual will be treated as a non-resident for income tax purposes. What is Full-Time Employment? The regulations clarify the definition of “full-time employment” and explain when an individual will be considered a “full-time employee” of an international organization. If an individual’s employment with the organization is “consistent with an employment schedule of a person with a standard full-time work schedule with the organization,” then that individual is considered to have full-time employment. Green Card Test Besides the Substantial Presence Test of [...]

Mishkin Santa

Areas of Expertise Offshore Voluntary Disclosure Practice Nonresident Alien Taxation US Taxation of International Organization Employees US Taxation of Foreign Pensions US Exit Tax US Taxation of Cryptocurrency US Taxation of PFICs Foreign Grantor and Non-Grantor Trust Taxation Individual Pre-Immigration Tax Planning Individual Cross-Border Tax Planning State Reciprocity Agreements Certifications/Credentials DC Bar Texas State Bar Washington State Bar US Tax Court Education Master’s Degree, Tax Law, Boston University J.D., Business Law, Tax Law, Seattle University School of Law Bachelor’s Degree, Business Administration and Management, Westminster College Languages Spoken English P Principal, Director of International Tax Mishkin is a Principal of The Wolf Group and oversees the firm’s international tax services in the areas of Offshore Voluntary Disclosure, US Exit Tax, foreign grantor and non-grantor trusts, nonresident alien taxation, international organization employee taxation, pre-immigration tax planning, and cryptocurrency. He assists individuals and businesses with highly specialized and complex tax issues related to offshore corporations, family businesses, trusts, and retirement plans. As a former Attorney with the IRS Chief Counsel, Mishkin is well-positioned to guide clients on a range of reporting and disclosure issues. In addition, he speaks regularly at professional events sponsored by attorney and CPA groups in the US and abroad. Before joining The Wolf Group, Mishkin was a Partner of the International Tax Division at the Krueger CPA Group. He split his time between the main office in Austin, Texas and the sister office in Zurich, Switzerland. Outside of work, Mishkin’s favorite activity is to spend time with his wife and two children. He also enjoys all things related to history, specifically Greek Mythology and the Argead Dynasty (Alexander the Great), Old Testament Bible, the rise and fall of the Roman Republic, the British Empire, and the Republic of the United States. He is also a big movie buff and fan of 80s and 90s pop culture.

Len Wolf

Areas of Expertise International organization employee and retiree taxation Expatriate taxation Trusts and estates Practice management Certifications/Credentials CPA, licensed in Virginia Education Bachelor of Science, Accounting, The Pennsylvania State University Languages Spoken English Principal, Director As the founder of The Wolf Group, P.C., Len remains an active Principal in the firm, providing guidance to the leadership team and working closely with both staff and clients. Since establishing the Firm in 1983, Len and his team have built a best-in-class, forward-looking international tax practice responsive to our clients and committed to success. In his early years at The Wolf Group, Len focused the practice on serving the needs of the international community, including organizations such as The World Bank, International Monetary Fund (IMF), OAS, United Nations, NATO, and others. As a result, The Wolf Group has been the premier provider of tax services for international organization employees and retirees for nearly four decades. In addition, Len has guided the firm in providing high-quality specialty expat and international tax services for individuals and privately held companies with international interests for more than 35 years. Prior to establishing The Wolf Group, Len was a member of the Finance and Accounting directorate of a defense contractor in Northern Virginia and served on the tax staff at Coopers & Lybrand, an international CPA Firm (predecessor of PWC). Len has chaired international tax committees and held various leadership positions in global professional organizations. He has regularly been invited to speak and publish on international and expatriate taxation at many international organizations, financial institutions, multinational companies, and international chambers of commerce, both in the U.S. and abroad. Len is a board member and active participant in a number of non-profit organizations dedicated to housing homeless families and meeting the mental health needs of underserved populations in our community. After work, he enjoys boating, travel, family get-togethers and Chesapeake Bay sunsets.

Jen Marenberg

AREAS OF EXPERTISE International and Expatriate Taxation Foreign Asset Reporting Practice Management CERTIFICATIONS CPA, licensed in Virginia Financial planning EDUCATION Masters of Accounting, University of North Carolina at Chapel Hill MBA, University of North Carolina at Chapel Hill BA, Intercultural Communication, Davidson College LANGUAGES French English Principal, Managing Director As Managing Director of The Wolf Group, Jen provides strategic direction and operational oversight to the firm. She is a CPA with more than 20 years of experience in the international tax and international development fields. Before assuming the Managing Director role in 2022, Jen oversaw the day-to-day operations of the firm for 6 years as Director of Operations. Her prior experience at The Wolf Group includes leadership positions on tax technical teams responsible for providing specialized tax services to clients with international concerns. These included expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees, and entrepreneurs with foreign interests. In that capacity, Jen assisted U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. She also worked closely with attorneys and other experts to support clients participating in the IRS’s Offshore Voluntary Disclosure Programs. Before joining The Wolf Group in 2013, Jen worked at Deloitte Tax, providing specialized tax services to expatriates, companies with global mobility programs, and international organizations. In addition, she spent the first 8 years of her career as a government contractor for the U.S. Agency for International Development (USAID), including a year on expatriate assignment in Iraq. Outside of work, Jen enjoys board games, card games, crafting, and reading.

IRS states its intent to send more targeted letters to cryptocurrency owners.

Judith McNamara, Director of Field Operations in the IRS Large Business and International Division, indicates that the IRS will send out more compliance letters in addition to the previous 10,000 that went out earlier in 2019.

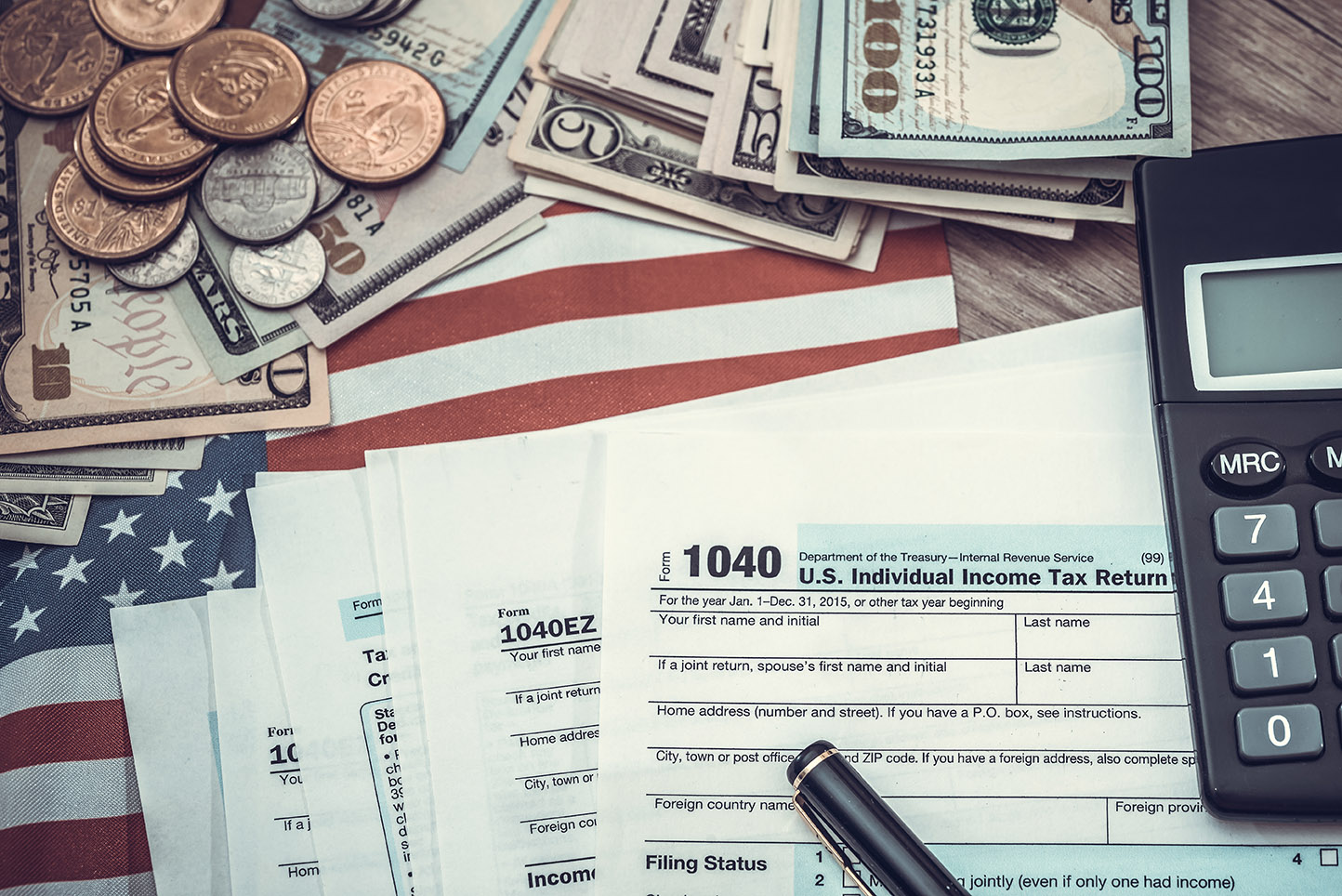

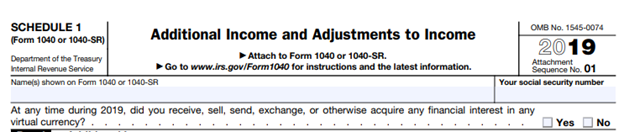

IRS reveals new cryptocurrency question on draft individual tax return.

The IRS releases draft 2019 Form 1040, Schedule 1, “Additional Income and Adjustments to Income,” which would require taxpayers to answer whether at any time during 2019 they sold, sent, or exchanged, or otherwise acquired any financial interest in virtual currency.

How Will the IRS Ever Know?

For years, new clients (and some of our current ones) have been asking why they should bother fixing their prior US tax filings to report previously unreported foreign income or foreign assets. The most common question is “How will the IRS ever know?” Years ago, this was a fair question. Now, less so. What changed? Why is the risk so much higher now? In recent years, the IRS has been amassing a wealth of tools and data that allow it to identify US taxpayers who have likely not been fully disclosing their overseas items. As a result, taxpayers now run a much higher risk of the IRS uncovering their current and past under-reporting. They remain non-compliant at their own peril. In the past ten years, the following developments have strengthened the IRS’s ability to identify US taxpayers with foreign assets: Beginning in 2009, Swiss (and other foreign) banks entered into agreements with the US Department of Justice (DOJ) to “tattle on” US clients. Swiss bank secrecy was shattered in 2009, when the DOJ announced that UBS entered into a Deferred Prosecution Agreement (DPA) related to the concealment of US taxpayer foreign financial assets and income. Since 2013, under the Swiss Bank Program, 82 foreign banks have entered into Non-Prosecution Agreements (NPAs) with the DOJ where, in exchange for lower fines and penalties on the banks, they provide details on US taxpayers with foreign financial assets and income. Switzerland was just the first country targeted by the DOJ’s Offshore Compliance Initiative. Since then, numerous other banks in former tax havens have negotiated similar arrangements. The IRS has amassed data from 10 years’ worth of IRS offshore amnesty programs, which it can now analyze and mine to identify other non-compliant individuals. US taxpayers are required to report their worldwide income and foreign financial assets annually on their tax returns and on international informational reports, such as FinCEN Form 114 (FBAR), Form 8938, etc. For taxpayers who failed to report these assets and/or associated income, the IRS offered multiple “amnesty” programs between 2009 and now that allow taxpayers to voluntarily come forward in exchange for lower penalties. The IRS estimates that more than 121,000 taxpayers have come forward and paid a total of $11.1 billion in back taxes, interest, and penalties. In addition, 1,545 taxpayers have been criminally indicted for tax crimes related to foreign financial asset disclosure. Now, the IRS has consolidated the data (and lessons learned) from these programs and is running analytics to identify likely non-compliant individuals. FATCA goes into full effect at the end of 2019, and numerous countries are sharing information on US taxpayers’ ownership of foreign accounts and assets. When the Foreign Account Tax Compliance Act (FATCA) was enacted in 2010, it required other countries to report to the IRS on US taxpayer ownership of bank and financial accounts abroad. Initially, this raised questions. Would other countries comply? How would the US enforce the Act? It turns out, these concerns were unfounded. Many countries have agreed to [...]

The Intersection of Qualified Opportunity Zones and Cryptocurrency

The Qualified Opportunity Zones (QOZ) rules became law under the Tax Cuts and Jobs Act (TCJA) of 2017. These rules are designed to encourage investment and economic growth in specific low-income areas. But there are important things to understand about Qualified Opportunity Zones and cryptocurrency. Can investors apply the QOZ rules to defer US tax on the gains from the sale of cryptocurrency? To answer that question, let’s start by reviewing how the QOZ rules work. What are the Tax Benefits of Investing in a QOZ? A taxpayer may defer gain from the sale or disposal of a capital asset if the gain is reinvested into a Qualified Opportunity Zone Fund (QOF) within 180 days of the recognition of the sale or disposal. The original gain is deferred until the taxpayer sells or exchanges the QOF interest or until December 31, 2026—whichever is earlier. If the deferred gain is held within the QOF for at least 5 years, the taxpayer will be able to exempt 10% of the deferred gain from federal tax. If the deferred gain is held within the QOF for at least 7 years, the taxpayer will be able to exempt an additional 5% from tax (for a total exemption of 15% of the deferred gain). If the taxpayer holds the investment for at least 10 years, the taxpayer will be able to exempt 100% of the post-reinvestment gain from federal tax. Can Gains from the Sale of Cryptocurrency be Deferred Under QOZ Rules? For a gain to be deferred under the QOZ rules, the gain must be from the sale or disposal of capital assets. But one of the biggest questions at the time the rules were promulgated was: What qualifies as a capital asset? Specifically, can a taxpayer defer the gain on the sale or disposal of cryptocurrency? Surprisingly, the answer to this question is yes. Although countries worldwide are still working out the details of what cryptocurrency is—money, a currency equivalent, property, or something else entirely—the IRS has already communicated its view. In guidance issued in 2014, the IRS was clear on this point: cryptocurrency is property for US tax purposes. As such, cryptocurrency is a capital asset, and the gain from the sale or exchange of cryptocurrency qualifies for deferral under QOZ rules. Illustration: The Intersection of QOZ and Cryptocurrency Here is an example of how a capital gain from the sale of cryptocurrency can work in conjunction with a QOZ. Assume that on December 31, 2019, taxpayer Jane realizes $20 million in long-term capital gains from the sale of bitcoin (a type of cryptocurrency). Jane conducts due diligence to find the proper QOZ investment. Jane invests the $20 million gain into her selected QOZ fund on June 1, 2020 (within the 180 days of the sale). Let’s assume that Jane ends up holding the investment for at least 10 years. Jane will have a $2 million exemption (10%) of the original gain on June 1, 2020. Jane will have an additional $1 [...]

Attorney Austin Carlson Weighs in on IRS Hot Topics

Business lawyer and CPA, Austin Carlson, deals with tax planning and controversy daily. We asked Austin to weigh in on IRS hot topics and to share some insights on timely tax issues that many of our international clients' face. Q: Based on the recent DOJ case against the Florida CPA who prepared a false “Streamlined Submission,” what is your advice for clients who need a “non-willful” determination and/or statement for a pending Streamlined Submission? Taxpayers who need to correct their past tax issues may qualify to use the Streamlined Filing Compliance Procedures, which allow for reduced penalties. To use this program, however, a taxpayer’s noncompliance must be “non-willful.” This case highlights the need to use an attorney as part of a team to prepare and submit submissions under the Streamlined Procedures. A determination of non-willful conduct is a legal determination that looks to the facts and circumstances surrounding a taxpayer’s conduct. It is vital to fully explore the facts and make sure that the taxpayer meets this standard. If the taxpayer does not meet the non-willful standard but still goes through the Streamlined Procedures, there can be significant consequences to both the tax preparer and the taxpayer. For taxpayers who do not meet the non-willful standard, there are options other than the Streamlined Procedures. Although the OVDP has closed, the IRS has released a guidance memorandum on how to come into compliance for taxpayers who do not qualify for the Streamlined Procedures. Q: What is your advice for individual US taxpayers living overseas who have a controlled foreign corporation and did not know they had to report the Transition Tax on their 2017 Individual Income Tax Returns? We regularly come across taxpayers who did not know about the significant international tax changes that were implemented by The Tax Cuts and Jobs Act of 2017. In addition to the Transition Tax reportable on 2017 tax returns, their 2018 and future tax years have several new tax planning traps to consider, such as Global Intangible Low-Taxed Income (GILTI). Taxpayers should connect with a qualified CPA as soon as possible to amend the 2017 tax return and work on tax planning for 2018 and going forward. Q: What is your advice for individuals who recently received a notice or letter from the IRS for failure to report income from cryptocurrency assets? In late August, the Internal Revenue Service sent another round of letters to crypto traders called CP2000. These notices were sent to traders of some crypto exchanges due to inconsistencies found in their tax reports. Using the information provided by third-party systems—such as crypto exchanges and payment systems—the IRS has been able to determine the amounts traders owe and included the amounts in dollars in the notices. Individuals who have received these notices are required to pay within 30 days, starting on the delivery date indicated in the letter. Cryptocurrency is a hot area for the IRS right now, and there is still uncertainty about both income tax treatment and information reporting [...]

IRS discloses estimates on cryptocurrency ownership in the US.

IRS Chief Counsel Michael J. Desmond indicates that an estimated 8% of adult Americans hold some form of cryptocurrency, so roughly 12 million should be reporting some type of cryptocurrency transaction.

IRS publishes new guidance and FAQs on cryptocurrency.

The IRS releases Rev. Rul. 2019-24 on the tax treatment of a cryptocurrency hard forks and a list of frequently asked questions (FAQs) that addresses virtual currency transactions for those who hold virtual currency as a capital asset. The IRS said it is supplementing 2014 guidance (Notice 2014-21) to help taxpayers understand their reporting obligations for specific transactions involving virtual currency.

IRS will continue use of John Doe summons to obtain cryptocurrency tax data.

The US Treasury Inspector General for Tax Administration (TIGTA) releases a list of planned audits for 2020, including the IRS’s use of John Doe summons data to ensure cryptocurrency tax compliance.