May 2021

US court case challenges taxation of staking activities.

In Jarrett v. United States, No. 3:21-cv-00419 (M.D. Tenn. 2021), Joshua Jarrett claims that the tokens he received in 2019 validating transactions in the cryptocurrency Tezos via a process called staking are not subject to tax. He argues that he created the tokens he received for validating transactions.

US proposed legislation seeks to protect taxpayers until IRS issues guidance on forked assets.

Rep. Tom Emmer, R-Minn. introduces legislation to prohibit penalties against taxpayers attempting to report certain gains or losses on “forked assets” until the IRS issues sufficient guidance on how to do so.

US District Court allows IRS to collect limited data from Kraken.

A California District Court approves a narrowed request for a John Doe summons to allow the proceeding against cryptocurrency exchange Kraken to move forward.

April 2021

IRS releases a memo that helps clarify its stance on hard forks.

IRS releases IRS Legal Memorandum (ILM) 202114020, which provides a helpful discussion of a typical hard fork event, as that term is understood within the cryptocurrency community. By contrast, in its October 2019 guidance (Rev. Rul. 2019-24, IRB 2019-44 p. 1004), the IRS described a hypothetical situation involving a hard fork followed by an airdrop.

March 2021

HMRC publishes cryptoasset taxation manual and guidance on “staking.”

The UK tax authority publishes a new cryptoasset taxation manual comprising previous advice and new guidance on the tax treatment of “staking” activities carried out by businesses and individuals. The manual incorporates policy papers published in 2018 and 2019 for individuals and businesses holding four types of cryptoassets: exchange tokens, utility tokens, security tokens, and stablecoins.

The State of Kentucky offers tax exemption for commercial cryptocurrency mining.

Kentucky H.B. 230, as signed into law, incorporates definitions and tax exemption application procedures regarding commercial cryptocurrency mining into the state tax code.

Why Has the Stock Market Soared While the Economy Has Been Struggling?

For the past 8 months, this question has been the most often-asked question of the team at Wolf Group Capital Advisors (WGCA), a sister firm of The Wolf Group. We recently connected with Bob Len, WGCA Managing Director, to solicit his thoughts on the matter. In this post, Bob shares a few key points that help to explain the seeming disconnect between stock market performance and the economic conditions of the past year. To set the stage, recall that in the latter half of 2020, the stock market continued to show strong performance, all while the economy seemed to be struggling. All of this was happening during a pandemic that was predicted to worsen. Many believed that investors were just creating a different reality and would be punished for their unrealistic optimism at some point. However, while the rapidity of the market recovery was surprising, there are rational explanations for why the markets moved the way they did. Markets tend to reflect what investors expect in 6 to 12 months. The first point to remember is that investors are looking to the future, so what is happening right at the current moment does not typically impact valuations. If we think back to mid-March 2020, we were all very concerned that the economy was shutting down. For those in the hospitality and travel sectors, their businesses did shut down. But for many in the services sectors, business, while impacted, did not shut down, and we pivoted to work from home. Our expectations in mid-March about our ability to do business in this new reality were very negative. But many of us found a way to continue to perform our jobs at near the same levels or with even higher productivity. So, the 35% market drop in March 2020 now is recognized as an over-reaction given how the economy continued to operate. The stock market is not necessarily representative of the economy. In the S&P 500, hospitality, including hotels and restaurants, is part of the Consumer Discretionary industry sector. Although this sector represents approximately 12% of the S&P index, hospitality is only a small part of that sector. Similarly, airlines are part of the Industrials sector, which is about 8% of the S&P. The airline industry is a small portion of the Industrials sector. So, the hardest hit industries in the pandemic only represent a very small part of the S&P 500 even though those two industries have a very large number of employees who were severely impacted by the pandemic. Stimulus efforts and the promise of a vaccine fueled investor optimism. There are any number of opinions as to why investors remained optimistic amid the economic uncertainties. One that has a lot of merit relates to the significant amount of stimulus injected into the economy by the US government and globally. As of the end of September 2020, the global stimulus was $12 trillion. With the second US stimulus package in December 2020 and other countries’ actions, the level is even [...]

February 2021

How Long Do You Really Have To Respond to an IRS Tax Due Notice?

If you live overseas, travel regularly, or split your time between different locations, you may have had the unpleasant experience of receiving an IRS notice after the payment due date listed in the notice. Or perhaps, during the COVID-19 pandemic, you were one of the many unlucky US taxpayers to receive an IRS tax notice requesting (or demanding) an immediate tax payment—or else. We receive numerous calls each year from US taxpayers in a panic because they have received a tax notice from the IRS, seeking immediate payment of an “overdue” amount. But how can you tell if you really owe the amount? What if you disagree? How much time do you really have to pay or resolve the issue before the IRS sends you to collections or starts going after your assets? In a previous blog post, we covered frequently asked questions about IRS tax notices. In this post, we explain: The steps and timeline in the IRS’s collection process How to tell which type of collection notice you are receiving and how urgent it is Your options at each step of the process Best practices for getting a final resolution Some Context Amid the COVID-19 Pandemic Note that this article explains what happens in “normal times,” but since these are not normal times, we also point out some differences in what’s happening now. The COVID-19 pandemic has affected both the volume of tax notices and taxpayers’ ability to reach the IRS and respond to notices timely. So, before we explain the steps and timeline in the IRS collection process, it’s important to understand a bit about what happened with tax notices in 2020 and where we are now. Although the IRS announced the “People First Initiative” on March 25, 2020, to deal with the pandemic, not all has gone smoothly. In 2020, the IRS was mostly shut down from roughly mid-March to early August, with many IRS employees working remotely or unable to fulfill their duties. The shutdown meant that the IRS accumulated a large mail backlog. In turn, this resulted in significant delays in the IRS’s processing of payments received and of taxpayer responses to collections notices. Meanwhile, the IRS’s automated computer systems continued to send tax notices to taxpayers, requesting payments and escalating collections issues. It wasn’t until August 2020 that the IRS suspended its automated collection notices. Then, later in 2020, when the IRS resumed the process of pursuing collections, many taxpayers were shocked. To their surprise, notices of “Final Notice of Intent to Levy” came out of the blue in the last quarter of 2020. Many taxpayers are still facing challenges in reaching IRS agents, getting their responses to tax notices processed timely, and achieving satisfactory resolutions. As a result, many have turned to the National Taxpayer Advocate, which indicated that it has added 50% more cases to its load for the first quarter of fiscal year 2021. Below, we outline the normal steps in the IRS’s collection process and also give points on [...]

Tax Relief for Individuals Affected by the Recent Winter Storms in Texas

On February 20, 2021, President Biden declared a “major disaster” for Texas due to the severe winter storms that lasted from February 11 through February 20. The storm caused significant issues, such as loss of power and water, home damage, water pipe damage, and other related issues. What relief is available to victims of the storms? Individuals who had a significant financial event due to the storms, such as home or water pipe damage, can obtain assistance through FEMA. (Note that individuals with insurance coverage should make an insurance claim first, as FEMA only provides relief if insurance doesn’t.) Individuals who need specific items, such as food, drinking water, and shelter, can obtain help from the North Texas Food Bank, Food Bank of the Rio Grande Valley, and various other organizations, all of which have obtained additional resources from recent fundraising drives. If Texas residents can’t get reimbursed for their losses via insurance or FEMA, some relief may be available via their tax returns, specifically via casualty loss rules on Schedule A, Itemized Deductions. Although the Tax Cuts and Jobs Act of 2017 (TCJA) made it harder to claim casualty losses on tax returns, affected Texans may be able to do so. Casualty Losses prior to the Tax Cuts and Jobs Act of 2017 Prior to TCJA: An individual could claim a deduction for a financial loss, such as a stolen car or computer, burst water pipe, or homeowner damage due to a natural event, such as a tornado or flood, as a “casualty loss” on Schedule A via IRS Form 4684. The amount of the casualty loss would be either (1) the adjusted basis of the property affected (most commonly, original cost less depreciation) or (2) the reduction in fair market value that the property sustained due to the casualty loss. Individuals could deduct only the amount of loss that exceeded 10% of their adjusted gross income. Note that to receive a tax benefit from the casualty loss deduction, individuals’ overall itemized deductions had to be greater than their standard deduction. This was the case for many homeowners pre-TCJA. The amount of the loss was reduced by $100 for each separate casualty loss event reported. Casualty Losses after the Tax Cuts and Jobs Act of 2017 Now, after TCJA, the rules are more restrictive: An individual can only deduct casualty losses that occur in a Federally Declared Disaster Area, i.e., the President of the United States must declare a disaster. Like before, only the loss in excess of 10% of adjusted gross income can be deducted. Also, as before, in order to benefit from the casualty loss deduction, an individual must itemize deductions instead of claiming the standard deduction. Since TCJA, itemizing has become less common. TCJA significantly increased the standard deduction amount, and since itemized deductions only make sense if the total itemized amount exceeds the standard deduction, fewer homeowners are now claiming itemized deductions. The $100 reduction-per-loss rules still apply. Since the storms ended on February 20, [...]

Cryptocurrency investigations in Denmark yield $4.9 million from 541 cases.

The Danish Tax Agency announces it collected $4.9 million in unpaid taxes as a result of 541 investigations of crypto traders that dealt in Bitcoin, Ethereum, and Ripple.

January 2021

US taxpayer contends expectation of privacy in use of cryptocurrency exchange.

In Harper v. Rettig, No. 1:20-cv-00771 (D.N.H. 2021), James Harper contends he had a contractual expectation with cryptocurrency exchanges that his data would not be shared without due process, while the Justice Department asserts that Harper sacrificed any privacy claims by transacting with third parties.

December 2020

US FinCEN announces its intent to make virtual currency accounts reportable on the FBAR.

In Notice 2020-2, the US Financial Crimes Enforcement Network (FinCEN) says it will propose to amend regulations regarding foreign bank account reports (FBARs) to include virtual currency accounts as a type of reportable account.

Bruno Block is indicted on tax evasion in the US.

Amir Bruno Elmaani, known online as “Bruno Block,” hid the vast bulk of his income from the initial coin offering of Pearl tokens behind nominees, while spending millions. The Justice Department announces Elmaani’s indictment in United States v. Elmaani, No. 20-cr-661 (S.D.N.Y. 2020), on two counts of Section 7201 tax evasion after he is arrested in West Virginia.

G-4s Are Receiving Worrying Letters from the IRS

The IRS is currently on a mission to identify individuals who haven’t been filing their US tax returns each year. It is specifically targeting individuals who the IRS suspects are “high-income non-filers.” As a result, many G-4 visa holders have recently ended up on the IRS’s radar. Why? Well, one of the techniques that the IRS is using to identify non-filers is also identifying G-4 visa holders who haven’t filed returns. These G-4s don’t necessarily have a US tax return filing requirement, but the IRS is unable to determine that from its records. So, instead, the IRS is sending a letter (Letter 2269C) to the G-4s indicating that they potentially should have been filing tax returns. Why is the IRS doing this? The IRS launched the “High-Income Non-Filer” campaign in February 2020. This campaign is part of the IRS’s efforts to close “the tax gap.” The tax gap represents taxes owed to the IRS but not yet collected, estimated at about $630 billion for 2020 alone. By targeting high-income individuals who should have filed tax returns but have not done so, the IRS expects high rates of return on its efforts in this campaign. Per Eric Hylton, the IRS Commissioner of the Small Business/Self-Employed Division, the campaign is about fairness: “Taxpayers who exercise their best efforts to file their tax returns and pay their taxes, or enter into agreements to pay their taxes, deserve to know that the IRS is pursuing others who have failed to satisfy their filing and payment obligations.” So why are G-4 visa holders being contacted? The IRS uses various techniques to try to identify individuals who should have filed returns but have not done so. These techniques are not foolproof. They end up identifying some individuals who were not required to file returns (like some G-4s), along with individuals who should have filed returns but did not do so (the intended targets of the campaign). The IRS does not disclose what techniques it uses to track down non-filers. However, it’s possible to deduce some of them from the letters the IRS has issued. For instance, as part of this campaign, the IRS is sending out Letter 2269C to individuals who have paid more than $10,000 in mortgage interest but have not filed tax returns. The logic is that such individuals may have unreported income and may owe back taxes, along with significant penalties. If you are a G-4 visa holder who owns property in the US but has not filed a US tax return, you may receive Letter 2269C. If a financial institution submitted a Form 1098 to the IRS to indicate that you paid more than $10,000 of mortgage interest during the year, then the IRS may: Suspect that you are a “high earner,” capable of owning a house with a large mortgage Conclude that there’s a good chance that you are residing in the US and are required to file a US tax return Assume that if a tax return was not filed [...]

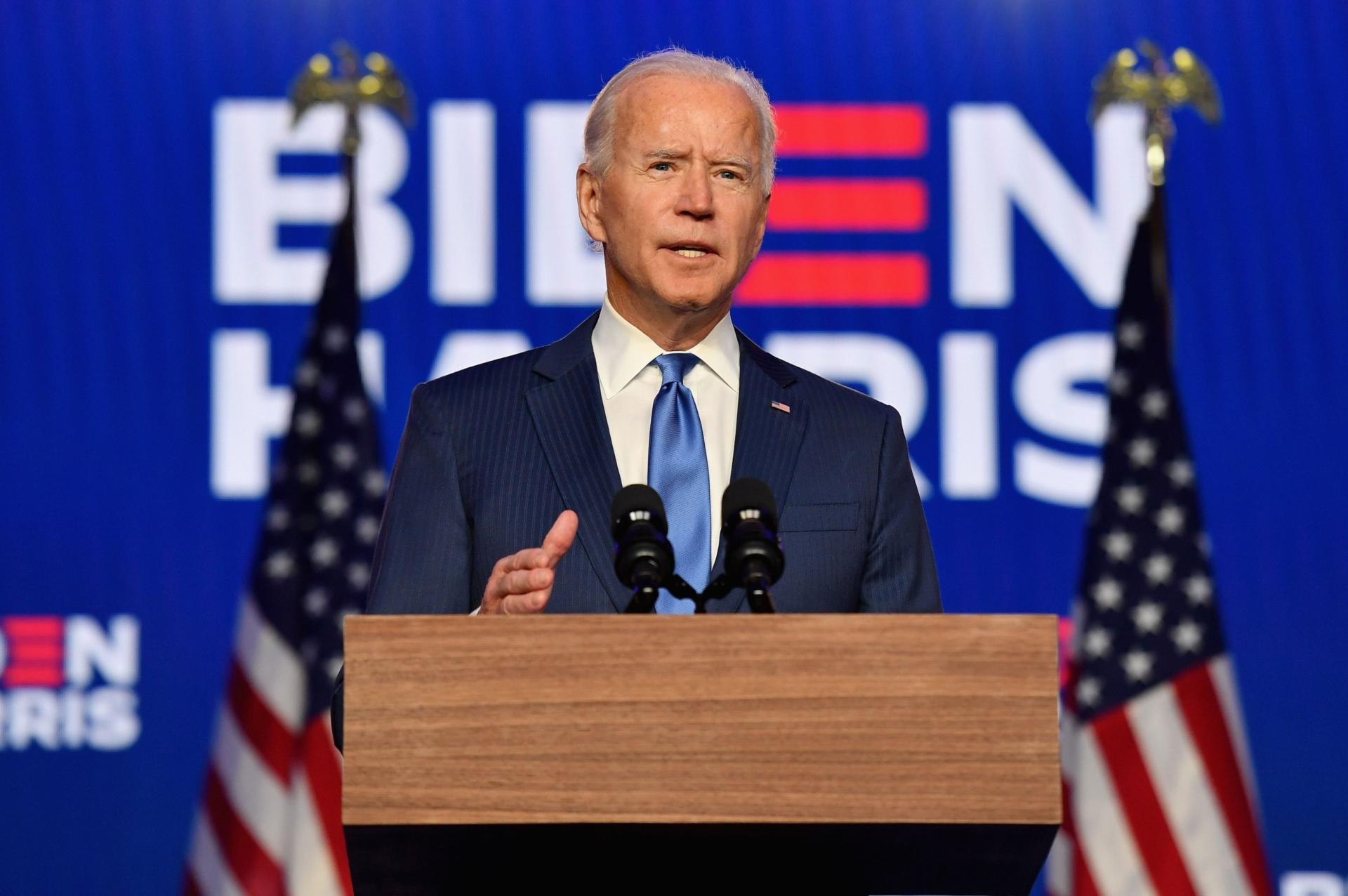

Will Your Taxes Go Up or Down under the Biden Tax Plan?

Will your taxes go up or down under the Biden Tax Plan? Many of you are asking this question. In a nutshell, the answer is that if you earn $400,000 or less annually, your taxes are likely to go down slightly. If you earn more than $400,000, your taxes are likely to go up, and the increase becomes more significant as your income substantially exceeds $400,000. But keep in mind that proposals are not law and may not become law. Given that the control of the US Senate in 2021 is uncertain at this time, it’s unclear whether the incoming Administration’s proposals will be enacted into law. Nevertheless, here is what President-elect Biden is proposing: Highlights of the Biden Tax Plan for Individual Taxpayers The Biden Tax Plan includes both elements that would increase taxes and elements that would decrease taxes. To understand how the Plan would affect you personally, you would need to weigh the increases that affect you (and their magnitude) versus the decreases that affect you (and their magnitude). The following proposals in the Biden Tax Plan would increase tax for certain taxpayers: Keep individual tax rates the same except for the top individual tax rate. Restore the top tax bracket to its pre-2018 levels. This would mean a tax rate of 39.6% would be applied to income above $400,000. Currently, the top rate is 37% and applies to income above $520,000 (Single filers) or $620,000 (Married Filing Jointly filers). Approximately 9% of taxpayers report income above $400,000. For individuals with income above $1,000,000, apply ordinary tax rates (e.g., 39.6%) to investment income that is presently capped at a 20% rate. This includes qualified dividends and capital gains. The additional 3.8% Net Investment Income Tax (NIIT) would also still apply. Impose a 6.2% social security payroll tax (a.k.a. FICA tax) on wages above $400,000. Currently, FICA taxes only apply on income up to $137,700. Under the proposal, FICA taxes would be paid both by the employee and employer on wages above $400,000. This would create a “donut hole” between $137,700 and $400,000 on which no social security taxes are payable. The proposal would not affect the current Medicare taxes of 1.45%, payable by both the employee and employer, or the Medicare surtax (.9%). These would continue to apply to all wages. Eliminate the step-up in basis on unrealized gains on assets upon death. This proposal would result in taxation of those gains at death. Currently, those unrealized gains go untaxed. Equalize the tax benefits of contributions to qualified retirement plans among low-, middle- and high-income taxpayers. Currently, contributions are deducted at the taxpayer’s highest tax rate, which results in greater tax savings to higher-income taxpayers. The Plan seeks to achieve parity by offering a 26% tax credit (regardless of income level) for IRA and 401(k) contributions, in lieu of a deduction. Close the tax loophole for “carried interest.” This loophole allows general partners of private equity and hedge funds to pay tax on elements of their compensation [...]

US pushes back in court case that IRS illegally obtained data on cryptocurrency transactions.

The US Government files a motion in a US District Court seeking the dismissal of an individual’s suit that alleged the government illegally obtained information regarding his virtual currency transactions and that sought declaratory and injunctive relief, arguing that the court lacks jurisdiction, and the complaint fails to state a claim on which relief can be granted (see James Harper v. Charles P. Rettig et al.; No. 1:20-cv-00771).

The Government files

The Government files a motion in a US district court seeking the dismissal of an individual’s suit that alleged the government illegally obtained information regarding his virtual currency transactions and that sought declaratory and injunctive relief, arguing that the court lacks jurisdiction, and the complaint fails to state a claim on which relief can be granted (see James Harper v. Charles P. Rettig et al.; No. 1:20-cv-00771).

IRS Offers New, Friendlier Payment Plans for Taxpayers during COVID-19

If you are having trouble paying your taxes, it often helps to take a proactive approach and agree on a payment plan with the IRS. As we all know, tax problems do not resolve themselves and will not get better with time. The IRS recently expanded its payment plans to help taxpayers who owe taxes. In this article, we describe the new relief options available to help you address your tax troubles. Pre-COVID, Old Installment Plans Before the IRS announced the new plans, if you owed taxes but were unable to make the payment in full, you could set up a payment plan or monthly installment agreement with the IRS. If you qualified for an installment agreement, you could pay off your tax balance by making monthly payments over a period up to 72 months. Later, that period was extended to 84 months for taxpayers who owed less than $100,000. To apply for the installment agreements, you generally had to provide a financial statement to the IRS to negotiate the payment terms. However, if your unpaid tax due was less than $50,000, you could potentially qualify for a Streamlined Installment Agreement. These agreements involved an online application and did not require you to disclose your financial statements. If you did not qualify for a monthly installment plan, the IRS might grant you 120 days to resolve your tax liability in another way. 2020 New Installment Plans In the midst of COVID-19 interruptions, the IRS announced new, easier payment plans for taxpayers who owe taxes and are struggling to pay the full amount all at once. (See IRS Taxpayer Relief Initiative, IR-2020-248, issued on November 2, 2020.) Some of the modifications create new relief for taxpayers with high unpaid taxes, while some provide more assistance for the taxpayers covered under the existing payment plans. Easier Process for Taxpayers with High Tax Amounts Due For taxpayers who owe up to $250,000 in taxes, the IRS modified the installment plan application process. Previously, if you owed more than $50,000, you were required to provide rigorous financial disclosures as part of your application for an installment agreement. Under the new process, if you owe up to $250,000 in taxes, you are no longer required to provide these financial disclosures, provided that you can pay the amount owed before the collection statute of limitations expires. (The statute of limitations for collections is typically 10 years. Scroll down for more information.) So, if your monthly payment proposal is sufficient, you can skip the financial disclosures and work with the IRS Automated Collection System (ACS) to reach an installment agreement. These new processes are currently available for taxpayers who have not yet been assigned to a revenue officer (or the Collection Unit). As far as we know, the new processes are temporary. So, those in need of relief should take advantage of them as soon as possible. Additional Time To Pay Taxes Not all taxpayers qualify for installment agreements. Instead, you may enter into a short-term arrangement [...]

November 2020

IRS further comments on the use of PLRs when cryptocurrency guidance falls short.

Suzanne Sinno, IRS Office of Associate Chief Counsel, indicates that the IRS has no blanket policy against issuing private letter rulings (PLRs) regarding the tax treatment of virtual currency transactions.

US District Court orders Coinbase to comply with limited IRS summons.

A US District Court, adopting a magistrate judge’s report and recommendation, denied an individual’s petition to quash and ordered the enforcement of an IRS summons issued to Coinbase, Inc. in its investigation of whether an individual correctly reported his cryptocurrency transactions. The court limited the scope of the summons (see William Zietzke v. United States; No. 4:19-cv-03761).