If you live overseas, travel regularly, or split your time between different locations, you may have had the unpleasant experience of receiving an IRS notice after the payment due date listed in the notice.

Or perhaps, during the COVID-19 pandemic, you were one of the many unlucky US taxpayers to receive an IRS tax notice requesting (or demanding) an immediate tax payment—or else.

We receive numerous calls each year from US taxpayers in a panic because they have received a tax notice from the IRS, seeking immediate payment of an “overdue” amount. But how can you tell if you really owe the amount? What if you disagree? How much time do you really have to pay or resolve the issue before the IRS sends you to collections or starts going after your assets?

In a previous blog post, we covered frequently asked questions about IRS tax notices.

In this post, we explain:

- The steps and timeline in the IRS’s collection process

- How to tell which type of collection notice you are receiving and how urgent it is

- Your options at each step of the process

- Best practices for getting a final resolution

Some Context Amid the COVID-19 Pandemic

Note that this article explains what happens in “normal times,” but since these are not normal times, we also point out some differences in what’s happening now. The COVID-19 pandemic has affected both the volume of tax notices and taxpayers’ ability to reach the IRS and respond to notices timely.

So, before we explain the steps and timeline in the IRS collection process, it’s important to understand a bit about what happened with tax notices in 2020 and where we are now.

Although the IRS announced the “People First Initiative” on March 25, 2020, to deal with the pandemic, not all has gone smoothly. In 2020, the IRS was mostly shut down from roughly mid-March to early August, with many IRS employees working remotely or unable to fulfill their duties. The shutdown meant that the IRS accumulated a large mail backlog. In turn, this resulted in significant delays in the IRS’s processing of payments received and of taxpayer responses to collections notices. Meanwhile, the IRS’s automated computer systems continued to send tax notices to taxpayers, requesting payments and escalating collections issues.

It wasn’t until August 2020 that the IRS suspended its automated collection notices. Then, later in 2020, when the IRS resumed the process of pursuing collections, many taxpayers were shocked. To their surprise, notices of “Final Notice of Intent to Levy” came out of the blue in the last quarter of 2020.

Many taxpayers are still facing challenges in reaching IRS agents, getting their responses to tax notices processed timely, and achieving satisfactory resolutions. As a result, many have turned to the National Taxpayer Advocate, which indicated that it has added 50% more cases to its load for the first quarter of fiscal year 2021.

Below, we outline the normal steps in the IRS’s collection process and also give points on best practices for responding to notices generally and during the ongoing pandemic.

IRS Standard Timeline & Escalation Process for Collecting Balances Due on Tax Returns

- Tax Return Balance Due. Typically, the IRS first becomes aware that you have a balance due when you file your US individual income tax return. In some cases, the balance due results because your tax return showed a tax amount due, which was not paid in full when you filed your return. In other cases, the IRS is assessing interest and/or penalties due to underpayments, late payments, late or missing foreign asset reporting forms, or other issues, resulting in payment due.

- 1st Balance Due Notice (CP14 or CP15). The IRS sends its first tax notice to collect on the balance due, normally 4 to 6 weeks after the return is electronically filed. The tax notice may be one of two forms:

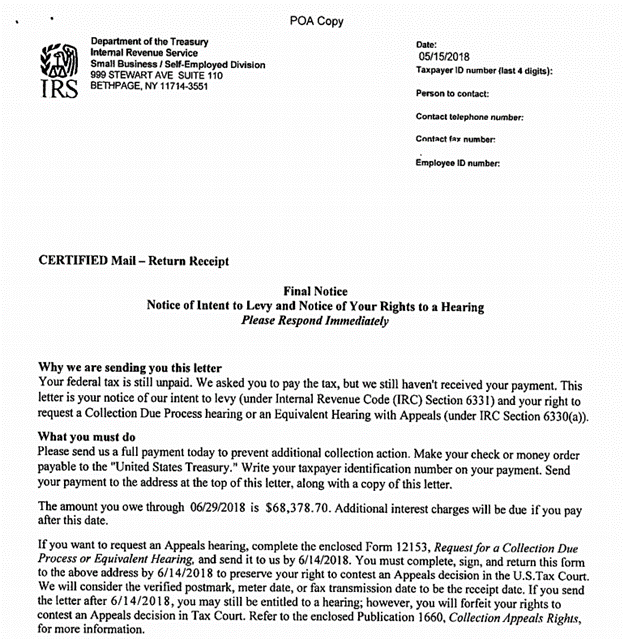

- CP14 Balance Due Notice (see Exhibit A), for most cases

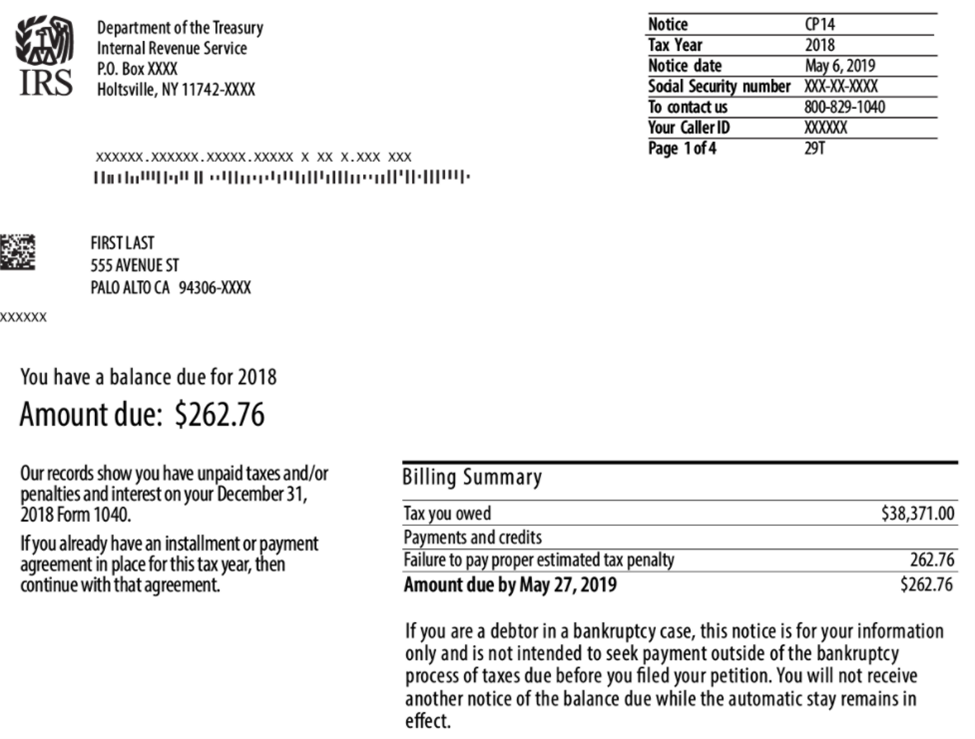

- CP15 Balance Due Notice (see Exhibit B), if the balance due is the result of a penalty for an international informational report (e.g., Forms 3520, 3520-A, 5471, etc.)

Regardless of which notice you receive, there will be a series of instructions on how to pay the balance due and the effective due date for the payment. If the balance due is not paid by the due date, then the collections process begins.

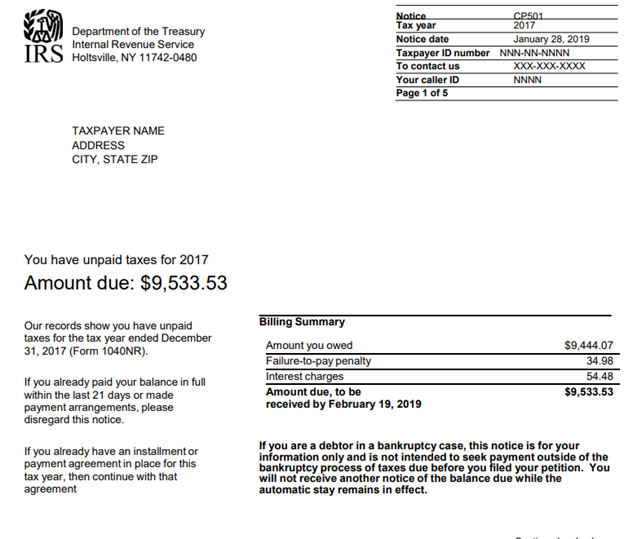

- 1st Collections Process Notice (CP501). The collections process is a 25-week process that starts with CP501 (Reminder Notice of Balance Due – See Exhibit C). Collection notices will always be dated on a Monday and will be issued every 5 weeks.

The CP501 Notice is a typical reminder notice. It has neutral language in its wording. As a matter of due diligence, if you are disputing the assessed tax or penalty due, you should respond in writing to each notice received. This helps develop the record should the matter be presented in a Collection Due Process or Appeals hearing.

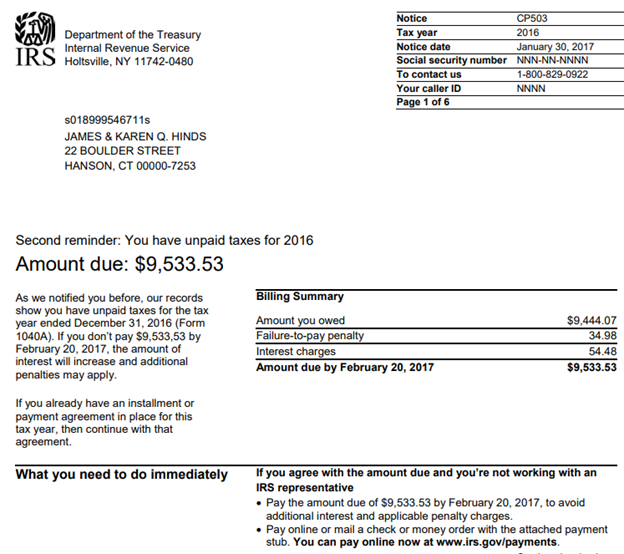

- 2nd Collections Process Notice (CP503). The next notice is the CP503 (see Exhibit D). The CP503 is the second reminder notice. The language is neutral with a sense of urgency. It clearly gives a due date and urges you to pay the balance due by that date or additional penalties and interest will apply.

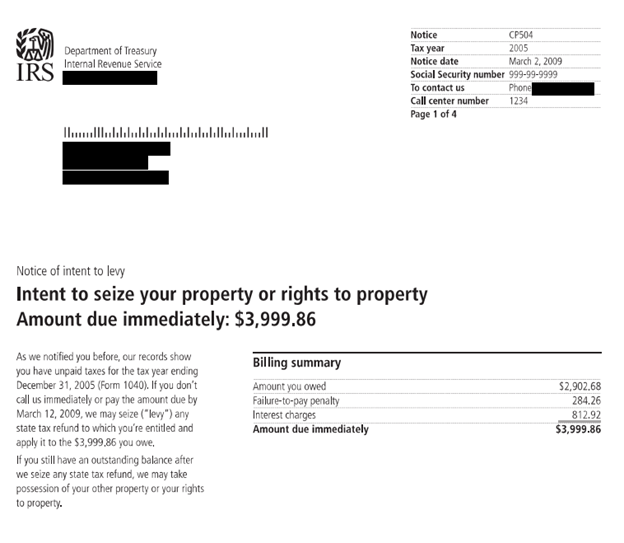

- 1st Notice of Intent to Levy (CP504). The next notice is the CP504 (see Exhibit E). The CP504 is a Notice of Intent To Levy. The language is somewhat harsh with a very high sense of urgency. The notice is designed to elicit a response from you. If you read the notice closely, however, it is not an actionable notice, as you cannot request a Collection Due Process Hearing via this notice. You must wait until the last notice to do this. If you do not pay the balance due for this notice, then the IRS could (or may) seize your state income tax refund (if you have one). Again, you should timely respond to each notice by sending a statement of disagreement and documented evidence if you plan to contest the balance due or penalty.

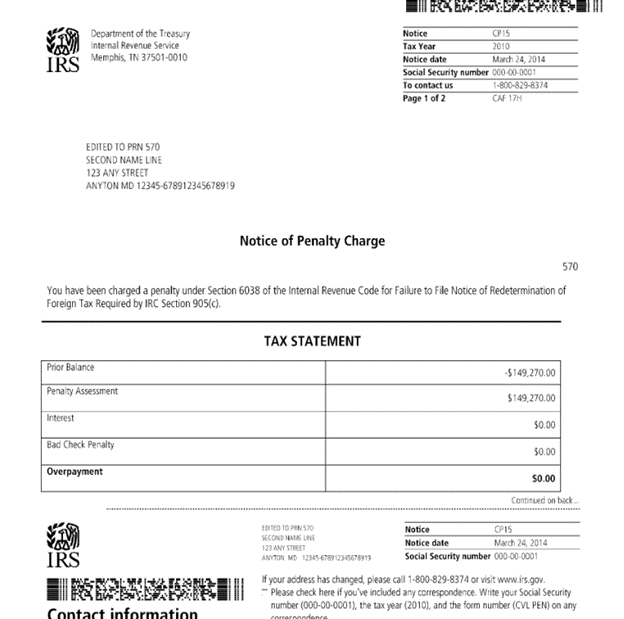

- Final Notice of Intent to Levy (Letter 11, formerly CP90 or CP1058). Lastly, the IRS will issue Letter 11 (see Exhibit F). Letter 11 used to be called CP90 or CP1058. This letter is the final Notice of Intent To Levy. The language in the letter is very harsh and has the highest sense of urgency. In particular, the IRS is stating that if a response is not received within 30 days, then it will levy money from all available financial assets (such as US domestic bank accounts, wages, etc.). Before the IRS can issue a levy, you have a right to request a hearing. To do so, you must file a timely request for a Collection Due Process Hearing, within the 30-day period issued in the notice.

Best Practices

- Respond to each notice. If you disagree with the notice, then you should send a timely response (and retain copies and proof of mailing) to each notice received. If you agree with the notice but cannot make payment in full, then the IRS will generally work with you to come to an arrangement, assuming that the IRS hears back from you!

- Be patient. Even before COVID-19, the IRS typically took 6 to 12 weeks or longer to process taxpayer responses to tax notices. Often, taxpayers would receive automated reminders or escalations from the IRS’s computer systems while waiting on the IRS to process their response. Early in the collections process, it can just be a matter of waiting on the IRS. If the process continues to escalate without a resolution, then you may need to enlist assistance from a tax practitioner or attorney.

- If you receive Letter 11, engage a tax practitioner or attorney to request a Collection Due Process Hearing. If you receive Letter 11, we would strongly urge that you retain representation to request a timely Collection Due Process hearing. Hearings must be requested within the 30-day window in the letter, and with the IRS mail processing backlogs, this can be problematic. Once scheduled, the hearing can be used to dispute the balance due or penalty. It can also be used to present collection alternatives, such an Installment Agreement or Offer in Compromise. In some cases, an Offer in Compromise (Doubt as to Liability) can be used to dispute an international informational report penalty that has been assessed improperly.

- Consider paying the balance due and then disputing it via a “Claim of Refund” on IRS Form 843. The IRS prefers this method as it shows good faith by you to pre-pay the balance at issue and avoid the cost and expense of the collections process. Prior to the pandemic, the timeline for resolution under this process was 8 to 12 months. During and after the pandemic, the timeline is unknown, especially given the IRS backlog of correspondence.

- If you retain representation from a tax practitioner or attorney, thoroughly vet the practitioner. If you choose to obtain representation through a practitioner to assist with this process, please make sure to thoroughly vet the credentials and reputation of the firm and practitioner you choose. The Office of Professional Responsibility (OPR) regularly publishes a list of practitioners that have been disciplined or have had their licenses revoked. The IRS also has a list of Federal Tax Return preparers and their credentials.

We hope you found this article to be generally helpful and informative. In many cases, taxpayers are able to interact with the IRS directly to resolve collection matters. However, if you are struggling to reach a satisfactory resolution or would like assistance in addressing a tax notice, please feel free to contact us. We assist numerous taxpayers in resolving such notices each year. Also, if you would like further information on IRS tax notices in general, or our related support, check out the Tax Audit Help section of our website.

Exhibit A

Exhibit B

Exhibit C

Exhibit D

Exhibit E

Exhibit F