March 2024

2023 FinCEN BOI Report Engagement Letter

Dear Client: We look forward to providing you with BOI Report preparation services! The purpose of this letter is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. What Services Are Covered under This Engagement? You have asked for our firm’s assistance to help you submit the initial Beneficial Ownership Information (“BOI”) report to the Financial Crimes Enforcement Network (“FinCEN”), as required under the Corporate Transparency Act (“CTA”). The BOI report is required to be submitted using FinCEN’s electronic filing system. For reporting companies in existence prior to January 1, 2024, the BOI report is due no later than January 1, 2025, and for reporting companies created on or after January 1, 2024, the BOI report is required to be filed within 90 days after their formation or registration. It is important that the specific facts and circumstances be considered to assess the applicability of the CTA-related provisions given the current guidance as promulgated. You have asked for our assistance to help you with your determination whether an exemption may apply to your entity or whether any relationships constitute “beneficial ownership.” Our limited advisory services for purposes of filing your initial BOI report under the terms of this agreement will be performed based on our professional judgment as accountants given the facts provided to us and the CTA provisions as currently promulgated. As we are not attorneys, we will not be rendering any legal advice or providing legal interpretation as part of this engagement. Subsequent developments changing the facts provided to us, or updated guidance from FinCEN or other regulatory agencies, may affect the advice previously provided. These effects may be material. Client agrees to provide us with all the required information and documentation deemed necessary to comply with applicable CTA regulations for your entity, all beneficial owners, and if applicable, the company applicant(s), for purposes of your BOI report filing. In connection with the performance of our limited services, we will rely on the accuracy and completeness of the information and documentation provided by Client and your representatives. We will not audit, review, or otherwise verify the information and documentation you provide, we cannot provide assurance on the accuracy and completeness of the information provided. Further, as we are not attorneys, we will not be responsible for making any legal determinations that may be required or for certifying or opining on your company’s compliance with the CTA. Client acknowledges and understands that under the terms of this agreement, Firm will not be responsible for providing any further services related to Client’s ongoing requirement to update and/or correct reports with FinCEN. Management, i.e., the designated responsibility individual person for the LLC, accepts full responsibility for monitoring all reportable changes for its company and its beneficial owners (e.g., a change in beneficial owners; any change to a beneficial owner’s name, address, [...]

February 2024

Cindy Gomez

Areas of Expertise Recruiting Benefits management Human resources Certifications/Credentials SHRM Certified Education Bachelor of Business Administration (HR Management), Baruch College Languages Spoken English Spanish (basic) Cantonese (basic) HR Associate As HR Associate at The Wolf group, Cindy champions recruiting efforts for open positions and provides assistance in employee relations, performance management, new hire onboarding, and staff training and development. In addition, she works to ensure that the firm remains in compliance with federal, state, and local employment laws and regulations. Prior to joining The Wolf Group, Cindy conducted full-cycle recruiting for professionals in the healthcare field. In addition, she spent 10 years with the International AIDS Initiative as an HR Generalist focused on benefits administration, recruiting, and performance management. Outside of work, Cindy enjoys trying new foods, bike riding with the family, and watching basketball and baseball.

January 2024

Jacque Stadler

Areas of Expertise Tax return processing Administrative support Client service Certifications/Credentials Notary Public - TX Education Notary Public - TX Languages Spoken English Tax Processor Jacque is a Tax Return Processor at The Wolf Group with more than 30 years of experience in tax return assembly, client service, and administrative support. At The Wolf Group, Jacque processes and delivers to clients all types of annual tax returns and tax forms, including those for individual taxpayers, partnerships, corporations, S corporations, fiduciaries, estates, trusts, and qualified retirement plans. She also processes amended returns and Streamlined Filings, prepares tax forms, and helps with other administrative tasks. Prior to joining The Wolf Group, Jacque worked in public accounting firms in several states, where she processed tax returns, served as office administrator, processed payroll, assisted with bookkeeping, and prepared various tax forms. Outside of work, Jacque enjoys gardening, traveling, riding dirt bikes, camping, and spending time with family.

Sakila Fazal

Areas of Expertise Expatriate and inpatriate taxation Global mobility tax Foreign asset reporting Certifications/Credentials CPA, licensed in Texas Enrolled Agent (EA) Education MS, Professional Accounting (MPAAC), University of West Georgia MS, Accounting and Finance, University of La Réunion, France BS, Economics & Management, University of La Réunion, France Languages Spoken French Gujrati English Senior Tax Specialist Sakila is a CPA and Senior Tax Specialist at The Wolf Group, with over 20 years of experience in the global accounting industry, having worked in the US and France (Ile de la Réunion). She specializes in providing tax guidance and assistance to a range of clients with international and cross-border needs, including: Companies with globally mobile staff (in matters of expatriate policy development, expatriate payroll, tax planning and counseling, US tax return preparation, and coordination of home and host country assistance) Individuals with complex, cross-border situations, including US citizens, green card holders, international organization employees, and US non-residents Individuals who have received tax notices and audits from the IRS or state taxing authorities Before joining The Wolf Group, Sakila worked for US public accounting firms for 11 years in expatriate and global mobility taxation, as well as 5 years in US individual taxation. In addition, she worked for a French public accounting firm, conducting financial audits and testing internal controls. Outside of work, Sakila enjoys traveling and spending time with family.

Carissa Aftab

Areas of Expertise US resident taxation US nonresident taxation International Organization taxation Education BS, Accounting, Liberty University (expected May 2024) Languages Spoken English Spanish Tax Specialist Carissa is a Tax Specialist on The Wolf Group team responsible for providing specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees. In this capacity, Carissa assists U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. Before joining The Wolf Group, Carissa had 15 years of experience managing business operations for a regional business with 60 employees. Among other responsibilities, she performed a range of tasks in accounting, payroll, cash disbursement, and tax preparation. Outside of work, Carissa enjoys spending time in nature, taking long hikes, exercising, and competing in local weightlifting competitions.

Vanessa Antoniazzi

Areas of Expertise US resident taxation US nonresident taxation International Organization taxation Accounting, budgeting, and financial management Education MBA, - Finance, Controllership, and Audit, Fundacao Getulio Vargas, Brazil BA, Accounting, Universidade de Caxias do Sul, Brazil Languages Spoken English Portuguese Tax Specialist Vanessa is a Tax Specialist on The Wolf Group team responsible for providing specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees. In this capacity, Vanessa assists U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. Before joining The Wolf Group, Vanessa had more than 20 years of experience in the accounting and tax industry in Brazil, where she was a partner in a Brazilian accounting firm and later the owner and manager of her own accounting and tax firm. She holds a Brazilian certification in public accounting (CRC-RS). In addition, after moving to the US, Vanessa worked as an accounting manager for 3 years in a large US company, where she handled day-to-day accounting, financial reporting, and financial management tasks. In her free time, Vanessa enjoys spending time with family, cooking new dessert recipes, and visiting new countries.

Stephne Flegel

Areas of Expertise US resident taxation US nonresident taxation International Organization taxation Military tax matters Certifications/Credentials Enrolled Agent (EA) Education MS, Leadership, American College of Financial Education (expected May 2024) BS, Accounting, Eastern Oregon University Languages Spoken English Tax Specialist Stephne is a Tax Specialist on The Wolf Group team responsible for providing specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees. In this capacity, Stephne assists U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. Before joining The Wolf Group, Stephne worked for 6 years as a tax return preparer and reviewer for a national tax preparation firm, where she prepared and reviewed various tax forms for individual clients, mentored new staff, and managed a high volume of tax cases. Outside of work, Stephne enjoys weight training, cooking and baking, and traveling.

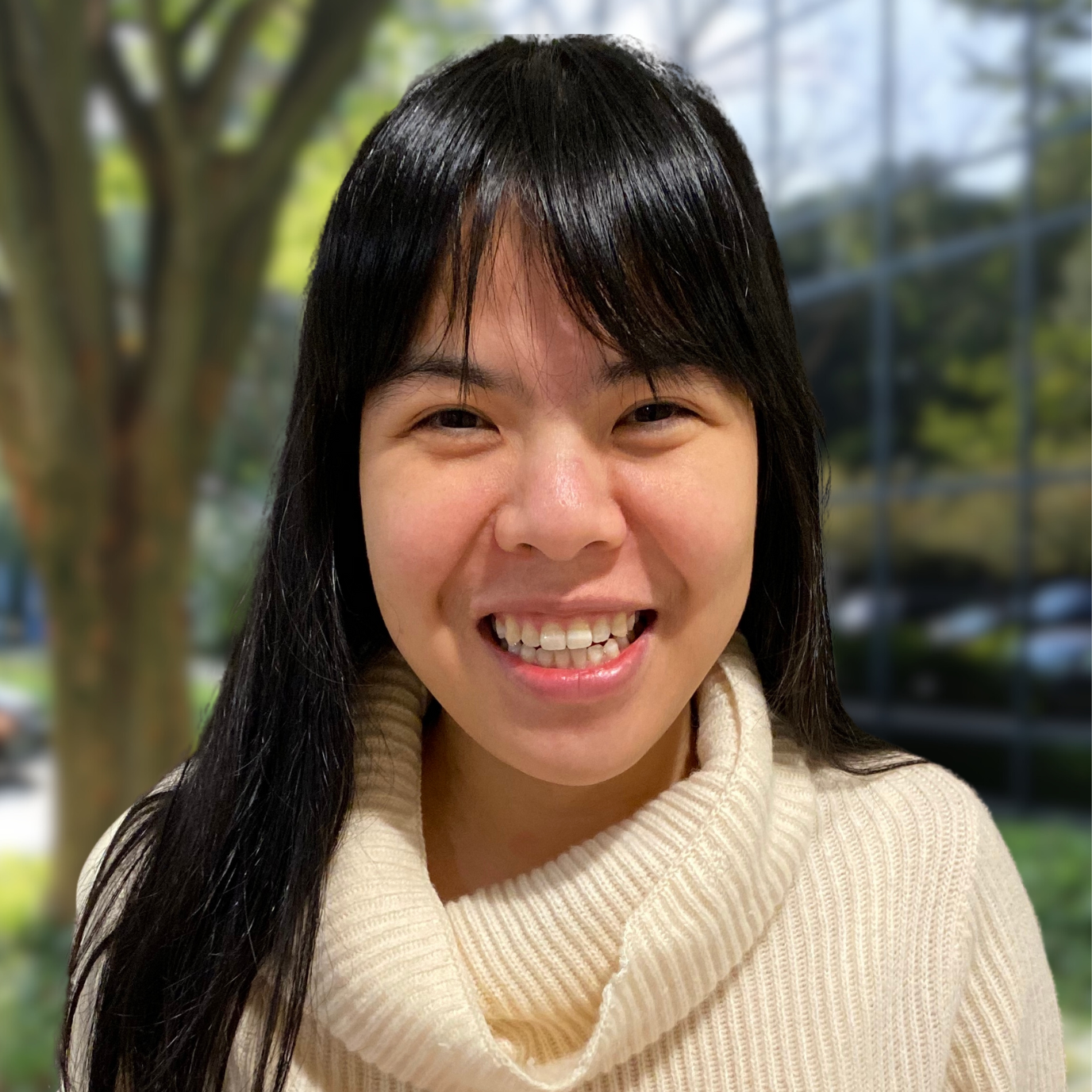

Susan Su

Areas of Expertise Business taxation and cross-border matters US reporting of foreign entities Expatriate taxation Foreign asset reporting Certifications/Credentials CPA, licensed in Washington State Education MS, Commerce & Accounting, Deakin University, Australia MS, Accounting, American University, United States BS, Accounting, Liaoning University, China Languages Spoken Mandarin Cantonese English Tax Specialist Susan is a CPA and International Tax Specialist at The Wolf Group, with experience working in the international tax and accounting industry, in China, Australia, and the US. At The Wolf group, she specializes in assisting entrepreneurs and multinational businesses with their international tax compliance needs. In her day-to-day work, she: Prepares business tax returns, including income tax returns for partnerships, corporations, and S corporations Prepares international tax forms required by the IRS to report clients’ ownership in foreign corporations, foreign partnerships, and other foreign entities Prepares individual tax returns for business owners, high-net-worth individuals, and foreign trusts Assists in properly reporting companies’ transactions with related parties, owners, and third parties Before joining the Wolf Group, Susan worked for 5 years as a Certified Practising Accountant and tax preparer in Australia. There, she prepared Australian tax filings for a variety of businesses and high-net-worth individuals. She also liaised with the Australian Tax Authorities, prepared financial statements, and performed a variety of accounting functions internally for a large Australian entity. In addition, she previously worked in the accounting industry in China, performing bookkeeping services, conducting tax research, resolving tax matters with the tax authorities, calculating payroll taxes, and filing Foreign Bank Account Reports (FBARs) for immigrant clients. Outside of work, Susan enjoys hiking, spending time with family, and cooking.

2023 Gift Tax Return Engagement Letter

Dear Client: The Wolf Group, P.C. is pleased to provide you with the professional services described below. This letter confirms our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. The engagement between you and our firm will be governed by the terms of this agreement. What Is the Scope of This Engagement? We will prepare the following federal gift tax return for the year ended December 31, 2023: Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return Federal and state law governs your obligation to file a gift tax return and pay gift tax. The Internal Revenue Service (IRS) considers a gift to be any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money’s worth) is not received in return. Under federal tax law, certain gifts are taxable and subject to an annual gift tax exclusion amount, which, for 2023, is $17,000 per taxpayer. In addition, a lifetime gift exclusion amount applies, which for 2023, is $12,920,000. State law governing gift taxes, including the lifetime exclusion, varies by jurisdiction. A gift tax return is an individual filing; there is no joint gift tax return. Under certain circumstances spouses may elect to “split” gifts. If you are eligible for, and elect gift-splitting, we will also prepare your spouse’s gift tax return. We will not prepare any tax returns except those identified above, without your written request, and our written consent to do so. We will prepare your gift tax return based upon information and representations that you provide to us. We will not prepare financial statements or valuations of any kind. We will not audit or otherwise verify the data you submit to us, although we may ask you to clarify certain information. We will prepare the above-referenced gift tax return solely to assist you with your filing obligations with the IRS and state and local tax authorities as identified above. Our work is not intended to benefit or influence any third party, either to obtain credit or for any other purpose. You agree to indemnify and hold us harmless from any and all claims arising from the use of the tax returns for any purpose other than complying with your tax filing obligations regardless of the nature of the claim, excepting claims arising from our gross negligence or intentional wrongful acts. The scope of our engagement is limited to the preparation of the gift tax returns listed above. It includes tax advice provided to you, as donor, regarding elections that can be made on gift tax returns. What Services Are Not Covered under This Engagement? (Some Are Offered as a Separate Engagement.) Tax planning services Our engagement does not include income, gift/transfer, or estate tax planning services. During the course of preparing the gift tax return identified above, we may bring to your attention potential tax savings strategies for you to consider as a possible means of reducing your taxes [...]

2023 Fiduciary Tax Return Engagement Letter (GF)

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. We strive to make our tax return process as straightforward and convenient as possible for you. Our goal is to minimize any hassle on your end while also making things as efficient as possible on our end. This allows us to deliver your returns expediently, while also bringing to bear a high level of technical expertise and personal service. It also helps us keep our costs down for all clients. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state fiduciary income tax returns. We will do so with the information you furnish to us in the process described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. Preparation of Forms 3520 and 3520-A (Foreign Gifts, Foreign Inheritance, Certain Foreign Trusts) If based on the information you have provided to us, we believe that you have a requirement to file Form 3520 and/or Form 3520-A, the preparation of those forms will be covered under this engagement. We will prepare those forms in conjunction with your fiduciary tax returns, under the same terms. What Is the Scope of This Engagement? This engagement is limited to the professional services outlined above. We will not prepare any tax returns other than those identified above, without your written request, and our written consent to do so. Also, we will not prepare financial statements or perform valuations of any kind. We will prepare the above-referenced tax returns solely to assist you with your tax filing obligations with the IRS and applicable state and local tax authorities. Our work is not intended to benefit or influence any third party, including any entity or investment which may seek to evaluate your creditworthiness or financial strength. What Services Are Not Covered under This Engagement? (Most Are Offered as a Separate Engagement.) The following services are examples of services that are outside the scope of this engagement. [...]

2023 Fiduciary Tax Return Engagement Letter

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. We strive to make our tax return process as straightforward and convenient as possible for you. Our goal is to minimize any hassle on your end while also making things as efficient as possible on our end. This allows us to deliver your returns expediently, while also bringing to bear a high level of technical expertise and personal service. It also helps us keep our costs down for all clients. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state fiduciary income tax returns. We will do so with the information you furnish to us in the process described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. Preparation of Forms 3520 and 3520-A (Foreign Gifts, Foreign Inheritance, Certain Foreign Trusts) If based on the information you have provided to us, we believe that you have a requirement to file Form 3520 and/or Form 3520-A, the preparation of those forms will be covered under this engagement. We will prepare those forms in conjunction with your fiduciary tax returns, under the same terms. What Is the Scope of This Engagement? This engagement is limited to the professional services outlined above. We will not prepare any tax returns other than those identified above, without your written request, and our written consent to do so. Also, we will not prepare financial statements or perform valuations of any kind. We will prepare the above-referenced tax returns solely to assist you with your tax filing obligations with the IRS and applicable state and local tax authorities. Our work is not intended to benefit or influence any third party, including any entity or investment which may seek to evaluate your creditworthiness or financial strength. What Services Are Not Covered under This Engagement? (Most Are Offered as a Separate Engagement.) The following services are examples of services that are outside the scope of this engagement. [...]

2023 Entity Tax Return Engagement Letter (CR)

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state income tax returns, with all required accompanying forms, statements, and schedules. We will do so with the information you furnish to us as described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. What Is the Scope of This Engagement? This engagement is limited to the professional services outlined above. We will not prepare any tax returns other than those identified above, without your written request, and our written consent to do so. We will prepare the above-referenced tax returns solely to assist you with your tax filing obligations with the IRS and applicable state and local tax authorities. Our work is not intended to benefit or influence any third party, including any entity or investment which may seek to evaluate your creditworthiness or financial strength. Note on Bookkeeping Assistance In some cases, we may determine that you require accounting and bookkeeping assistance solely for the purpose of preparing the tax returns. These services are typically outside the scope of tax return preparation. As such, in most cases, we will provide you with referrals to bookkeepers. In limited cases, we may provide you with such assistance directly. In those cases, these services will fall under the scope of this engagement letter and will be performed solely in accordance with the AICPA Code of Professional Conduct. In the event we conclude that such services are necessary to prepare your tax returns, we will bill you for the required services. You agree to pay for those required services. What Services Are Not Covered under This Engagement? (Most Are Offered as a Separate Engagement.) The following services are examples of services that are outside the scope of this engagement. However, we regularly assist clients with many of these matters. Should you request these additional services, and we agree to provide them, [...]

2023 Entity Tax Return Engagement Letter

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state income tax returns, with all required accompanying forms, statements, and schedules. We will do so with the information you furnish to us as described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. What Is the Scope of This Engagement? This engagement is limited to the professional services outlined above. We will not prepare any tax returns other than those identified above, without your written request, and our written consent to do so. We will prepare the above-referenced tax returns solely to assist you with your tax filing obligations with the IRS and applicable state and local tax authorities. Our work is not intended to benefit or influence any third party, including any entity or investment which may seek to evaluate your creditworthiness or financial strength. Note on Bookkeeping Assistance In some cases, we may determine that you require accounting and bookkeeping assistance solely for the purpose of preparing the tax returns. These services are typically outside the scope of tax return preparation. As such, in most cases, we will provide you with referrals to bookkeepers. In limited cases, we may provide you with such assistance directly. In those cases, these services will fall under the scope of this engagement letter and will be performed solely in accordance with the AICPA Code of Professional Conduct. In the event we conclude that such services are necessary to prepare your tax returns, we will bill you for the required services. You agree to pay for those required services. What Services Are Not Covered under This Engagement? (Most Are Offered as a Separate Engagement.) The following services are examples of services that are outside the scope of this engagement. However, we regularly assist clients with many of these matters. Should you request these additional services, and we agree to provide them, [...]

2023 Gift Tax Return Engagement Letter (GF)

Dear Client: The Wolf Group, P.C. is pleased to provide you with the professional services described below. This letter confirms our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. The engagement between you and our firm will be governed by the terms of this agreement. What Is the Scope of This Engagement? We will prepare the following federal gift tax return for the year ended December 31, 2023: Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return Federal and state law governs your obligation to file a gift tax return and pay gift tax. The Internal Revenue Service (IRS) considers a gift to be any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money’s worth) is not received in return. Under federal tax law, certain gifts are taxable and subject to an annual gift tax exclusion amount, which, for 2023, is $17,000 per taxpayer. In addition, a lifetime gift exclusion amount applies, which for 2023, is $12,920,000. State law governing gift taxes, including the lifetime exclusion, varies by jurisdiction. A gift tax return is an individual filing; there is no joint gift tax return. Under certain circumstances spouses may elect to “split” gifts. If you are eligible for, and elect gift-splitting, we will also prepare your spouse’s gift tax return. We will not prepare any tax returns except those identified above, without your written request, and our written consent to do so. We will prepare your gift tax return based upon information and representations that you provide to us. We will not prepare financial statements or valuations of any kind. We will not audit or otherwise verify the data you submit to us, although we may ask you to clarify certain information. We will prepare the above-referenced gift tax return solely to assist you with your filing obligations with the IRS and state and local tax authorities as identified above. Our work is not intended to benefit or influence any third party, either to obtain credit or for any other purpose. You agree to indemnify and hold us harmless from any and all claims arising from the use of the tax returns for any purpose other than complying with your tax filing obligations regardless of the nature of the claim, excepting claims arising from our gross negligence or intentional wrongful acts. The scope of our engagement is limited to the preparation of the gift tax returns listed above. It includes tax advice provided to you, as donor, regarding elections that can be made on gift tax returns. What Services Are Not Covered under This Engagement? (Some Are Offered as a Separate Engagement.) Tax planning services Our engagement does not include income, gift/transfer, or estate tax planning services. During the course of preparing the gift tax return identified above, we may bring to your attention potential tax savings strategies for you to consider as a possible means of reducing your taxes [...]

December 2023

2023 Individual Tax Return Engagement Letter (CR)

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter and attached “Additional Engagement Terms” is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. We strive to make our tax return process as straightforward and convenient as possible for you. Our goal is to minimize any hassle on your end while also making things as efficient as possible on our end. This allows us to deliver your returns expediently, while also bringing to bear a high level of technical expertise and personal service. It also helps us keep our costs down for all clients. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state individual income tax returns. We will do so with the information you furnish to us in the process described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. Preparation of Certain Dependent Tax Returns In some cases, a dependent or minor child under your care and supervision may be required to file a U.S. income tax return, state income tax return, and/or International Informational Report (e.g., FinCEN Form 114 (FBAR)). Generally, if you request that we prepare such forms on your dependent’s behalf, we will consider that service to be covered under the current engagement as a “dependent tax filing,” and we will bill the preparation to you based on our most recent tax preparation fee schedule. However, in some circumstances, we may require that the preparation be handled under a separate engagement, with an additional Engagement Letter to be completed by you, the parent or guardian. In that case, we will notify you of the requirement for a separate engagement. Preparation of Forms 3520 and 3520-A (Foreign Gifts, Foreign Inheritance, Certain Foreign Trusts & Foreign Pensions) If based on the information you have provided to us, we believe that you have a requirement to file Form 3520 and/or Form 3520-A, the preparation of those forms will be covered under this engagement. We will prepare those forms in conjunction with your individual tax [...]

2023 Individual Tax Return Engagement Letter

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter and attached “Additional Engagement Terms” is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. We strive to make our tax return process as straightforward and convenient as possible for you. Our goal is to minimize any hassle on your end while also making things as efficient as possible on our end. This allows us to deliver your returns expediently, while also bringing to bear a high level of technical expertise and personal service. It also helps us keep our costs down for all clients. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state individual income tax returns. We will do so with the information you furnish to us in the process described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. Preparation of Certain Dependent Tax Returns In some cases, a dependent or minor child under your care and supervision may be required to file a U.S. income tax return, state income tax return, and/or International Informational Report (e.g., FinCEN Form 114 (FBAR)). Generally, if you request that we prepare such forms on your dependent’s behalf, we will consider that service to be covered under the current engagement as a “dependent tax filing,” and we will bill the preparation to you based on our most recent tax preparation fee schedule. However, in some circumstances, we may require that the preparation be handled under a separate engagement, with an additional Engagement Letter to be completed by you, the parent or guardian. In that case, we will notify you of the requirement for a separate engagement. Preparation of Forms 3520 and 3520-A (Foreign Gifts, Foreign Inheritance, Certain Foreign Trusts & Foreign Pensions) If based on the information you have provided to us, we believe that you have a requirement to file Form 3520 and/or Form 3520-A, the preparation of those forms will be covered under this engagement. We will prepare those forms in conjunction with your individual tax [...]

2023 WGCA Client Tax Return Engagement Letter

Dear Client: We look forward to providing you with tax return preparation services this year! The purpose of this letter and attached “Additional Engagement Terms” is to specify the terms of our engagement and clarify the nature and extent of the services we will provide. This way, you know what to expect from us, and we can endeavor to delight you with high-quality, seamless services. We strive to make our tax return process as straightforward and convenient as possible for you. Our goal is to minimize any hassle on your end while also making things as efficient as possible on our end. This allows us to deliver your returns expediently, while also bringing to bear a high level of technical expertise and personal service. It also helps us keep our costs down for all clients. What Services Are Covered under This Engagement? Preparation of U.S. Federal and State Returns With this letter, you are engaging us to prepare your 2023 U.S. and state individual income tax returns. We will do so with the information you furnish to us in the process described below. If you have taxable income or loss in a state or locality other than your resident state, we will generally prepare your nonresident state or locality returns, as well, unless you indicate in advance that you prefer we not prepare these nonresident filings. Preparation of Foreign Bank Account Reports (FBARs) If based on the information you have provided to us, we believe that you have a requirement to file FinCEN Form 114 (otherwise known as a Foreign Bank Account Report or “FBAR”), the preparation of your 2023 FBAR(s) will be covered under this engagement. If you prefer that we not prepare your FBAR(s), you may opt out by checking the appropriate box in your annual tax questionnaire or notifying us in writing. Preparation of Certain Dependent Tax Returns In some cases, a dependent or minor child under your care and supervision may be required to file a U.S. income tax return, state income tax return, and/or International Informational Report (e.g., FinCEN Form 114 (FBAR)). Generally, if you request that we prepare such forms on your dependent’s behalf, we will consider that service to be covered under the current engagement as a “dependent tax filing,” and we will bill the preparation to you based on our most recent tax preparation fee schedule. However, in some circumstances, we may require that the preparation be handled under a separate engagement, with an additional Engagement Letter to be completed by you, the parent or guardian. In that case, we will notify you of the requirement for a separate engagement. Preparation of Forms 3520 and 3520-A (Foreign Gifts, Foreign Inheritance, Certain Foreign Trusts & Foreign Pensions) If based on the information you have provided to us, we believe that you have a requirement to file Form 3520 and/or Form 3520-A, the preparation of those forms will be covered under this engagement. We will prepare those forms in conjunction with your individual tax [...]

November 2023

Lexus Lambert

Areas of Expertise Client relations Project management Operations and data analytics Education MBA, Leadership and Management, Carlow University BS, Criminal Justice, Robert Morris University Languages Spoken English Client Relationship Manager Lexus is a Client Relationship Manager (CRM) at The Wolf Group, responsible for overseeing the client experience for both US and foreign national clients. She works closely with tax technical professionals and reaches out to clients to ensure the smooth flow of information and high-quality services. In addition to her CRM role, Lexus assists with the continuous improvement of processes and workflow within the firm, primarily among operations functions, to maintain the firm’s high standards of exceptional internal and external services. Before joining The Wolf Group in 2023, Lexus worked as an Operations and Analytics Associate for a private equity firm’s portfolio cybersecurity & risk department. There, she supported more than 200 clients, company leadership, and vendors. She also previously as a Legal Administrator and Litigation Assistant for the State of Pennsylvania, where she was responsible for serving clients and attorneys by developing and monitoring cases and documentation. Outside of work, she enjoys traveling, exercising, binge watching psychological thriller limited series, and spending time with family and friends.

Violet Lee

Areas of Expertise Client relations Project management Intercultural communications Education BA, Psychology, University of Maryland-BC Languages Spoken Korean English Client Relationship Manager Violet is a Client Relationship Manager (CRM) at The Wolf Group, responsible for overseeing the client experience for both US and foreign national clients. She works closely with tax technical professionals and reaches out to clients to ensure the smooth flow of information and high-quality services. As the CRM for the firm’s Team Lobo, Violet largely supports clients who are international organization employees, G-4 visa holders, non-resident filers, high-net-worth individuals, and retirees. She keeps clients abreast of new developments, facilitates communications with tax preparers, monitors the progress of engagements, and coordinates services. In addition, she helps those who are new to the US tax system to understand the filing process and what to expect. Before joining The Wolf Group in 2023, Violet worked for a Maryland small business with 200 employees, supporting company leadership, vendors, and business partners. She handled logistics, operations, and executive support functions, as well as client relationship matters. She also has prior experience teaching music and tutoring. A native of Korea, Violet speaks fluent Korean and English. Outside of work, she enjoys board games, movies, and spending time with her family.

September 2023

June 2023

Thu Ngo

Areas of Expertise US resident taxation US nonresident taxation International organization employees and retirees Education BS, Accounting, University of Houston-Clear Lake Languages Spoken English Vietnamese Tax Specialist Thu is a Tax Specialist on The Wolf Group team responsible for providing specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees. In this capacity, Thu assists U.S. citizens, green card holders, and foreign nationals with their individual income tax matters. She also prepares amended tax returns under IRS Amnesty programs, such as the IRS Streamlined Foreign and Domestic Filing Procedures. Before joining The Wolf Group, Thu volunteered at The BakerRipley Neighborhood Tax Centers, where she provided free tax preparation services to those in need, while completing her degree in accounting. Outside of work, Thu enjoys playing guitar, trying new restaurants, and traveling.

Christina Kosier

Areas of Expertise US resident and expatriate taxation US nonresident taxation International organization taxation Gift, trust and estate taxation Tax research and advisory Education MS, Taxation, University of Albany BS, Accounting, University of Albany Languages Spoken English Tax Senior Christina is a Tax Senior at The Wolf Group, with more than 15 years of experience in the Financial Services industry. At The Wolf Group, she provides specialized tax services to clients with international concerns, including expatriates, inpatriates, and high-net-worth individuals with global assets, as well as international organization employees and retirees. In this capacity, Christina assists US citizens, green card holders, foreign nationals, and US businesses with their income tax matters. She also prepares amended tax returns under IRS Amnesty programs, such as the IRS Streamlined Foreign and Domestic Filing Procedures. Before joining The Wolf Group, Christina worked for 8 years as a tax professional at a small accounting firm, where she was responsible for preparing a wide range of tax returns including individuals, businesses, gifts, trusts, estates, and not-for-profits. She also spent 5 years in the Gift, Trust, and Estate division of a large wealth management firm. Outside of work, Christina enjoys hiking, kayaking, improvising in the kitchen, wandering museums, discovering old bookstores, and spending quality time with her family.

Jill McDade

Areas of Expertise Learning and development Quality assurance Client relations Education BA, West Virginia University Languages Spoken English Senior Quality & Training Specialist As Senior Quality and Training Specialist at The Wolf Group, Jill drives initiatives to promote high client satisfaction, ensures the consistency of quality and service delivery across the firm, and puts in place tailored staff development and training programs for all employees. The Wolf Group has a 40-year history of excellent quality and client service. Jill’s role was created in 2021 specifically to perpetuate and foster these positive client experiences as the firm continues to grow and evolve, nimbly adjusting to the ever-changing tax landscape and market forces. Before joining The Wolf Group, Jill served as a Leadership Development Coordinator for new and experienced managers with a large US Government defense contractor, where she implemented leadership development models and business solutions. Jill has also served as an Advanced Relationship Manager and Branch Operations Champion at an international bank, where she built connections with high-net-worth clients who live and travel around the globe. Outside of work, Jill enjoys boating on Chesapeake Bay and attending dinner parties with her family and friends.

Clarisa Thompson

Areas of Expertise Administrative support Client service Languages Spoken English Office Assistant As Office Assistant at The Wolf Gorup, Clarisa provides administrative, office, and client assistance in support of the firm’s operations. She handles incoming mail and notices, scans and saves clients’ documents to their files, provides support to client relationship managers during tax busy seasons, and collaborates with tax staff on a variety of office matters. She also assists with special initiatives within the firm.

Oksana Deputat

Areas of Expertise US global mobility & expatriate taxation US gift, trust, and estate taxation US resident and nonresident taxation Foreign asset reporting Credentials CPA, licensed in Florida Education Master of Accounting, Florida State University Bachelor of Accounting, Florida State University Languages Spoken Ukranian English Russian (basic) Senior Tax Specialist Oksana is a CPA and Senior Tax Specialist on The Wolf Group team responsible for providing specialized tax services to high-net-worth individuals, fiduciaries, family groups, and individuals with global assets, as well as international organization employees and retirees. In her day-to-day work, Oksana: Prepares tax returns for fiduciaries (trusts and estates), high-net-worth individuals, and family groups Assists US citizens, green card holders, trusts, estates, and families with their income tax matters, foreign asset reporting, and tax planning Assists clients in filing amended tax returns under IRS Amnesty programs, such as the IRS Streamlined Foreign and Domestic Filing Procedures Before joining The Wolf Group, Oksana worked for two large US public accounting firms as an experienced tax preparer in global mobility taxation. She prepared tax returns and tax equalization calculations for expatriates, employees on overseas assignment with their employers, and other high-net-worth individuals. In her free time, Oksana enjoys reading, spending time with family and friends, and traveling.