Will your taxes go up or down under the Biden Tax Plan? Many of you are asking this question. In a nutshell, the answer is that if you earn $400,000 or less annually, your taxes are likely to go down slightly. If you earn more than $400,000, your taxes are likely to go up, and the increase becomes more significant as your income substantially exceeds $400,000.

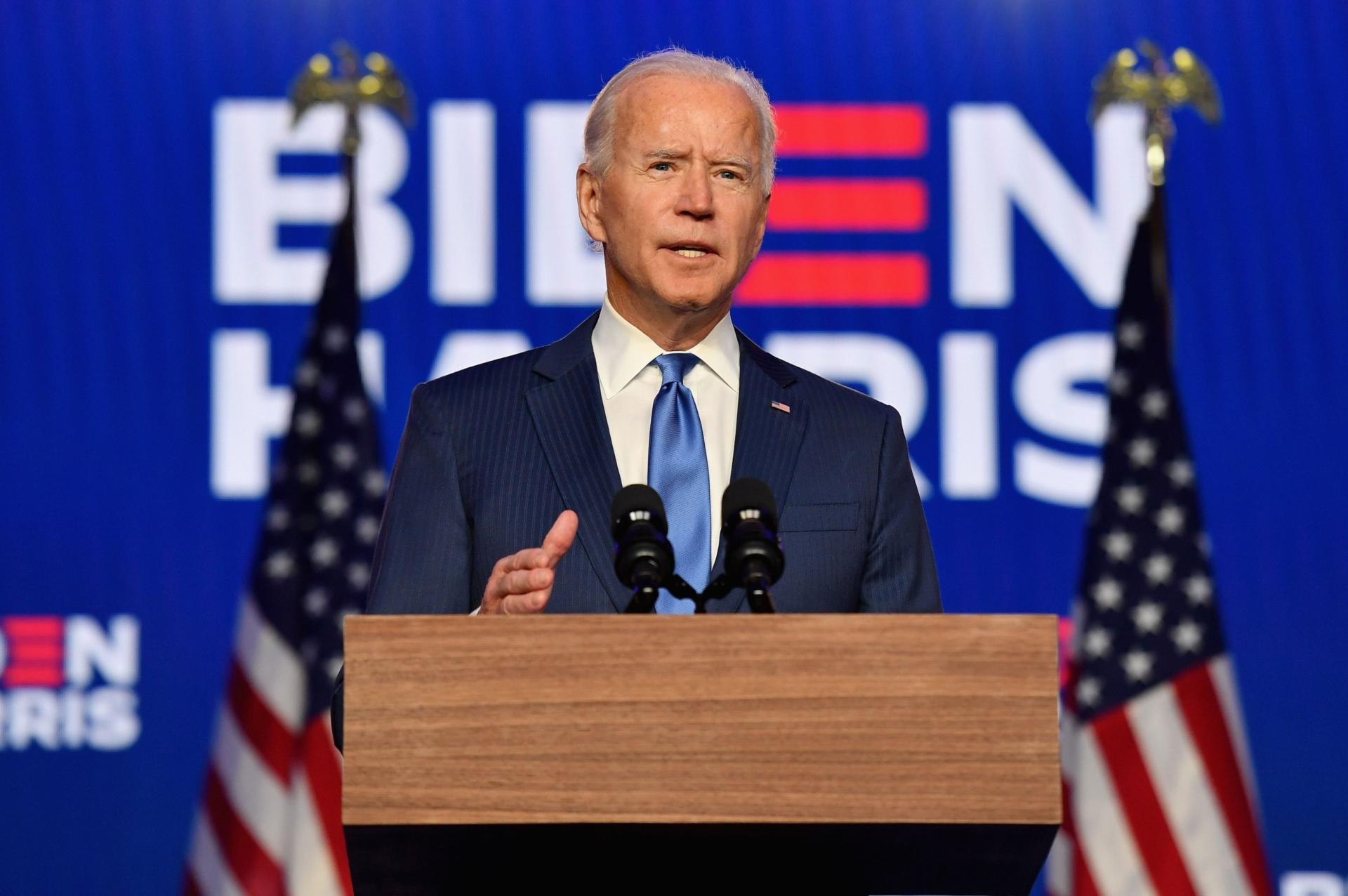

But keep in mind that proposals are not law and may not become law. Given that the control of the US Senate in 2021 is uncertain at this time, it’s unclear whether the incoming Administration’s proposals will be enacted into law. Nevertheless, here is what President-elect Biden is proposing:

Highlights of the Biden Tax Plan for Individual Taxpayers

The Biden Tax Plan includes both elements that would increase taxes and elements that would decrease taxes. To understand how the Plan would affect you personally, you would need to weigh the increases that affect you (and their magnitude) versus the decreases that affect you (and their magnitude).

The following proposals in the Biden Tax Plan would increase tax for certain taxpayers:

- Keep individual tax rates the same except for the top individual tax rate. Restore the top tax bracket to its pre-2018 levels. This would mean a tax rate of 39.6% would be applied to income above $400,000. Currently, the top rate is 37% and applies to income above $520,000 (Single filers) or $620,000 (Married Filing Jointly filers). Approximately 9% of taxpayers report income above $400,000.

- For individuals with income above $1,000,000, apply ordinary tax rates (e.g., 39.6%) to investment income that is presently capped at a 20% rate. This includes qualified dividends and capital gains. The additional 3.8% Net Investment Income Tax (NIIT) would also still apply.

- Impose a 6.2% social security payroll tax (a.k.a. FICA tax) on wages above $400,000. Currently, FICA taxes only apply on income up to $137,700. Under the proposal, FICA taxes would be paid both by the employee and employer on wages above $400,000. This would create a “donut hole” between $137,700 and $400,000 on which no social security taxes are payable. The proposal would not affect the current Medicare taxes of 1.45%, payable by both the employee and employer, or the Medicare surtax (.9%). These would continue to apply to all wages.

- Eliminate the step-up in basis on unrealized gains on assets upon death. This proposal would result in taxation of those gains at death. Currently, those unrealized gains go untaxed.

- Equalize the tax benefits of contributions to qualified retirement plans among low-, middle- and high-income taxpayers. Currently, contributions are deducted at the taxpayer’s highest tax rate, which results in greater tax savings to higher-income taxpayers. The Plan seeks to achieve parity by offering a 26% tax credit (regardless of income level) for IRA and 401(k) contributions, in lieu of a deduction.

- Close the tax loophole for “carried interest.” This loophole allows general partners of private equity and hedge funds to pay tax on elements of their compensation at lower capital gains rates rather than at the higher ordinary tax rates that apply to salary and wages.

- Expand estate and gift taxes by restoring the top tax rate and exemption levels to those of 2009 (45% and $3,500,000, respectively). Currently, these stand at 40% and $11,580,000, respectively.

- Phase out the Qualified Business Income (QBI) deduction, enacted in 2017, for taxpayers with incomes above $400,000.

- Eliminate the ability for rental property owners who “actively participate” in the management of their rental properties to deduct up to $25,000 in current-year losses. Instead, such owners would carry forward those losses to future years, to offset future rental income or gain from the sale of the property.

- For taxpayers with incomes greater than $400,000, cap the benefit of claiming itemized deductions to a 28% rate. This would mean that while income above $400,000 would be taxed at a 39.6% rate under the Plan, itemized deductions would only yield a tax reduction of 28% of the itemized deduction amount.

- Reinstate the “3% of Adjusted Gross Income (AGI)” reduction of itemized deductions and apply it when AGI exceeds $400,000. Thus, itemized deductions would be reduced by 3% of the taxpayer’s AGI that exceeds $400,000.

The following proposals in the Biden Tax Plan would decrease tax for certain taxpayers:

- Expand the $2,000 child tax credit to $3,000 per child aged 6–17 and $3,600 per child for children under age 6, during the pandemic and perhaps beyond. Plus, make the child tax credit fully refundable instead of partially non-refundable. (A non-refundable credit is one that can reduce a taxpayer’s tax liability to $0 but won’t result in a refund. A refundable credit is one that results in the government actually paying the taxpayer a refund to the extent that the credit exceeds his or her tax liability.)

- Increase the child and dependent care credit to 50% (from 35%) on qualified expenses up to $8,000 (from $3,000).

- Create additional renewable energy credits.

- Make available “health premium tax credits” for families whose premiums exceed 8.5% of their income. The credit would be refundable.

- Create a new tax credit of up to $5,000 to offset the cost of caring for an aging loved one.

- Offer a first-home buyer tax credit of up to $15,000 (advanceable to the date of purchase).

- Expand the Earned Income Credit (EIC) to apply to childless workers over age 65.

What is the macro tax effect of the Biden Plan?

Although your individual or family’s circumstances will determine the ultimate impact of these changes on you, various organizations have estimated the average impact on families at different income levels.

Forbes projects an average tax decrease of $540 for a family earning $88,000–$160,000, and $920 for a family earning $50,000–$90,000.

The Tax Policy Center projects an average increase of 2.4% for a taxpayer earning $400,000–$790,000. Average increases for taxpayers earning more than $790,000 are significantly impacted by the increase in tax rates on capital gains and qualified dividends, and estimates vary considerably among studies. The projections are largely dependent upon which estate-related tax increases are considered.

When could the Biden Tax Plan take effect?

In order for the Biden Tax Plan (or any of its provisions to take effect), the US Congress would need to legislate and approve the changes. So, President-elect Biden cannot act on his own.

As mentioned above, given that control of the US Senate is uncertain, it’s unclear whether the Biden Plan would have the necessary support to pass. Sixty votes (out of 100) are needed in the US Senate to enact legislation unless the legislation is enacted by “reconciliation.” (“Reconciliation” is a legislative process that expedites the passage of certain budgetary legislation. The 2017 tax legislation, the Tax Cuts and Jobs Act, or TCJA, was enacted via reconciliation.)

Furthermore, even if Congress passes tax legislation, it’s unclear how much the final tax legislation would reflect the proposals from President-elect Biden’s original plan.

If the incoming Administration does succeed in passing new tax legislation, the timing would depend on:

- When and how quickly the US House of Representatives and Senate move to pass tax legislation

- Whether and how quickly the US House of Representatives and Senate can reach agreement and garner the necessary support

- Whether the tax legislation is made retroactive (for example, to the beginning of 2021)

What do we expect will happen?

In a country as divided as the US currently is, we expect that President-elect Biden will face challenges in advancing his tax agenda and other priorities.

We are currently in a period of relative uncertainty and instability in the US tax world. Whenever major tax law changes are passed without bipartisan support (as was the case in 2017), then those changes risk being overturned each time a new political party comes to power. This results in uncertainty and instability for individuals and businesses alike. Plus, certain key provisions passed in 2017 are due to expire in 2025, further complicating planning.

At this point, we expect that President-elect Biden will succeed in advancing some tax law changes, specifically those that have the best chance of garnering bipartisan support. However, it’s doubtful that the full package of his proposed changes would be enacted.

That said, even if the Biden Administration struggles to get new legislation passed, it could advance some of its priorities by using regulatory changes to modify how current tax law is interpreted and administered.

Want to know more about what to expect in 2021?

If you’d like to know more about our predictions and the impact of upcoming events, join us for a free webinar on the Biden Tax Plan and 2021 expectations, on January 14, 2021. During the webinar, we will:

- Further discuss the Biden Tax Plan proposals

- Explore the impact of the Georgia special run-off elections for US Senate seats (scheduled for January 5, 2021)

- Discuss our views on likely scenarios for the Biden Tax Plan and tax law changes during 2021

Also, if you have particular concerns about your own tax situation and would like more clarity, we are currently conducting 2020 year-end tax planning. Feel free to contact us for assistance.

The Wolf Group, PC, has been assisting individuals and privately held businesses with international tax complexity for more than 35 years. We advise clients on tax-savings opportunities, provide year-end tax planning, and provide a range of advisory and tax preparation services tailored to clients’ needs.