Many G4 visa holders are confused over their US tax residency status. They have heard that merely holding a G4 visa entitles the holder to be a non-resident. But this is not true. The US income tax code and regulations don’t even mention “G4 visas.” Then why are most G4’s considered nonresidents? And more importantly, why does it matter?

Nonresident vs. Resident Taxation and Why it Matters

A foreign national (who is a non-US citizen) may be taxed under the US income tax system as either a resident or a non-resident.

A non-resident is only taxable in the United States on US source income. This includes wages for work performed in the United States. It also includes US source investment income, such as dividends received from US corporations. This does not include wages earned by a G4 visa holder from an international organization.

US tax residents are subject to US income tax on their worldwide income. Worldwide income includes earnings from all sources. Even income that is also taxed in another country. US tax residents must also report foreign financial assets that exceed certain thresholds on forms like the FBAR and Form 8938. Lastly, US tax residents may also have international informational reporting for any interests owned in foreign businesses and/or trusts.

G4 Visa Holders and the “Substantial Presence Test”

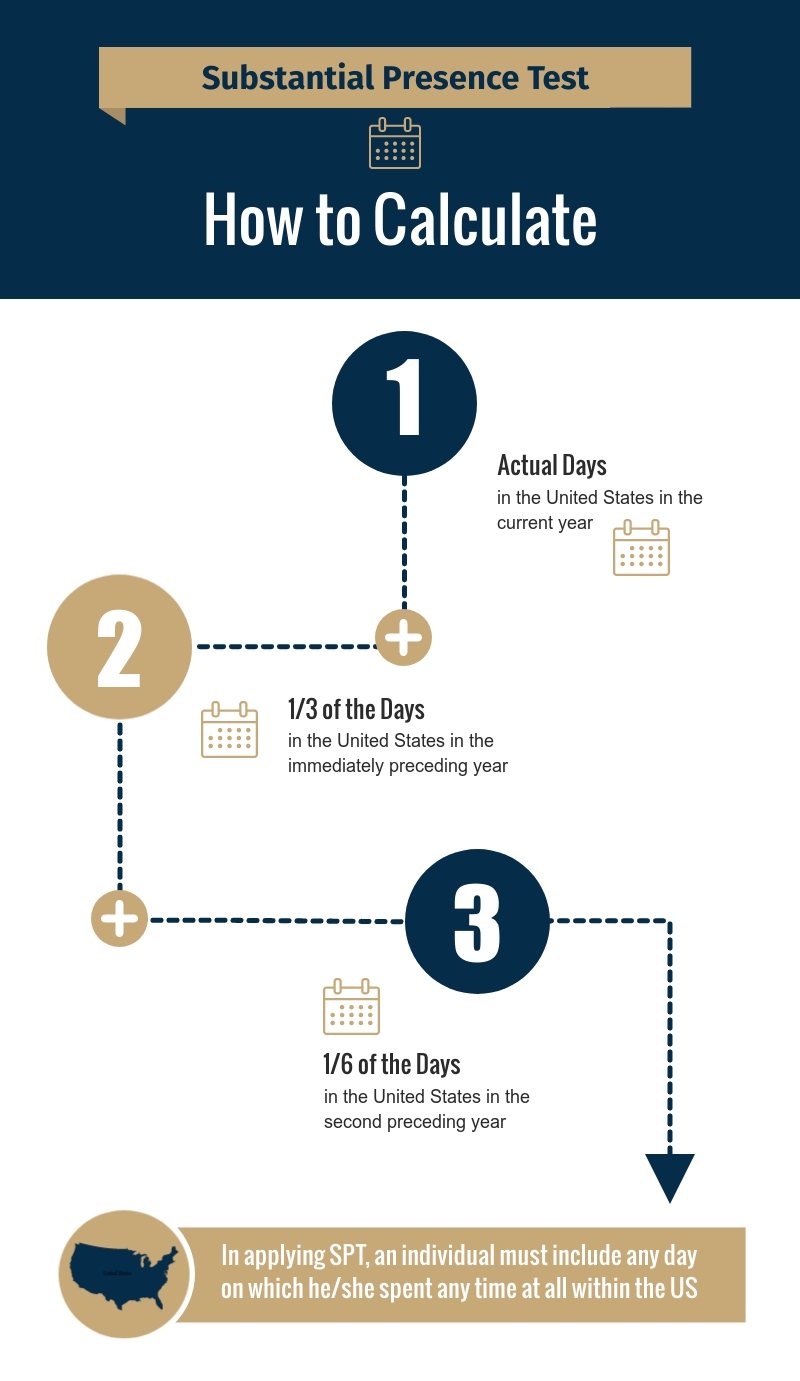

The general rule under the US tax code is that a foreign national who is present in the United States for 183 days or more in a calendar year becomes a US income tax resident under the so-called Substantial Presence Test (SPT). Also, if the person is present in the United States on at least 31 days of the current calendar year, he or she may be classified as a US tax resident if his/her days of US presence exceed 182 days using the following formula:

An Exception to General Rule—“Exempt Individuals”

A notable exception under the Substantial Presence Test of residency provides that any day that an individual is present in the US as an “exempt individual” is not counted as a day of US presence. An “exempt individual” includes a foreign national who is present in the US because of “his or her full-time employment with an international organization.” Also included are the immediate family of an exempt individual (spouse and unmarried children under 21 years of age).

Therefore, while a G4 visa holder is employed and working on a full-time basis for an international organization, his/her days are not counted as US days, and the individual will be treated as a non-resident for income tax purposes.

What is Full-Time Employment?

The regulations clarify the definition of “full-time employment” and explain when an individual will be considered a “full-time employee” of an international organization. If an individual’s employment with the organization is “consistent with an employment schedule of a person with a standard full-time work schedule with the organization,” then that individual is considered to have full-time employment.

Green Card Test

Besides the Substantial Presence Test of residency, another way a foreign national may become a US tax resident is through the Green Card Test. This test is satisfied if a person has obtained lawful permanent resident status under US immigration laws. A person who is approved for a “Green Card” is a tax resident from the first day of physical presence in the United States under that status. To determine a taxpayer’s residency, start date, one must look at both the Substantial Presence Test and Green Card Test to determine which one applies first.

6013(g) and 6013(h) Elections

The last way for a foreign national to become a US tax resident is to make a 6013(g) or 6013(h) election. A 6013(g) election is made when a foreign national is married to a US citizen or resident, and the foreign national is a nonresident at the close of the tax year. The foreign national can make the election to file a “joint tax return” and be treated as a US tax resident. The election is a one-time election that holds until revoked.

A 6013(h) election is made when a foreign national is married to a US citizen or resident, and the foreign national was a nonresident at the beginning of the tax year but a resident at the close of the tax year. The foreign national can make the election to file as a “full-year” tax resident and therefore file a joint tax return with his or her spouse.

Of course, the above rules are only the general rules of tax residency as applied to G4 visa holders. There are many exceptions and exceptions to those exceptions. If you are concerned about your tax residency status, we encourage you to seek guidance from one of our international tax professionals.