Executive Order: US Professionals Can No Longer Provide Services to Clients inside the Russian Federation

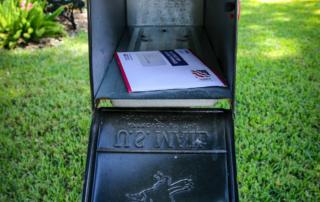

As of June 7, US companies and individuals will be prohibited from providing services to anyone located within the Russian Federation, including US citizens living in Russia. Background On April 6, 2022, President Biden signed Executive Order 14071, prohibiting new investment and services to [...]