Many people are happy that 2009 is over. The year was full of unexpected and gut-wrenching events – the deepest recession in a generation, the worst bear market since the Great Depression, the highest unemployment rate since the early 1980s, large bankruptcies, massive government intervention, and so forth. Yet, the news was not all bad. The US economy, despite fears to the contrary earlier in the year, proved to be quite resilient, and actually logged positive GDP growth by the third quarter of the year. Many corporations, which had aggressively cut costs in the early stages of the recession, were able to report better-than-expected earnings consistently throughout the year. Most importantly, none of the doomsday scenarios (collapse of the US banking system, stock market falling to zero, Culture Club reunion, etc.) so freely bantered about in the early part of the year, actually happened. For equity investors 2009 represented a surreal mix of angst and elation, of grief and relief, of despair and repair. It will be a year to remember, unless of course Einstein’s quip about memory is valid – “Memory is deceptive because it is colored by today’s events.”

Fourth Quarter Review

Following the stock market’s strong performance in the second and third quarters of 2009, it would have been reasonable to expect more modest returns in the final three months of the year. Although not as strong as in previous marking periods, the S&P 500 still managed to rise 5.5% in the fourth quarter, which in any other year would have been considered outstanding.

The same forces which drove the market higher earlier in the year were still in force during the fourth quarter, namely: rising corporate profits, low interest rates, mixed sentiment and an excess of cash on the sidelines. Gold has also shown an unusual positive correlation to the US stock market in recent months, leading some to suggest that the rise in stocks, bonds and commodities may be linked directly, and perhaps exclusively to low interest rates. Professional investors who can borrow money at low rates and invest it in appreciating assets may be an unusually strong force in these markets’ performance as of late. Although conclusive data is hard to find, it appears that individual investors are not yet a major force in the equity market.

The bond market now appears to be fully recovered from the effects of the credit crunch. During the 2nd and 3rd quarters of 2009 investors scooped up almost $2 trillion of new bond issuance as corporations raced to borrow at these historically-low interest rates. In the 4th quarter, the pace of issuance waned as investors consolidated their gains, perhaps apprehensive of what comes next. Government bonds and the highest quality corporate bonds appear to be quite expensive and do not seem to offer much value to investors.

Here’s what the fourth quarter looked like by the numbers:

| Index | 4th Qtr 2009 | 2009 |

|---|---|---|

| Dow Jones Industrial Average | 7.4% | 18.8% |

| S&P 500 | 5.5% | 23.5% |

| NASDAQ | 6.9% | 43.9% |

| Russell 2000 | 3.5% | 25.2% |

| MSCI EAFE | 2.0% | 27.0% |

| MSCI EAFE Small Cap | 0.0% | 42.9% |

| MSCI Emerging Markets | 7.5% | 69.0% |

| Barclays Aggregate Bond | -0.4% | 2.3% |

| Barclays Municipal Bond | -1.2% | 10.0% |

| Dow Jones Commodities | 9.0% | 18.7% |

Surreal Times, Really

Since the beginning of the financial crisis, we all have witnessed many things which have stretched the limits of belief — the collapse of Bear Sterns, Lehman Brothers, AIG, General Motors and Chrysler; the US government taking over large sectors of the economy, massive layoffs, painful declines in asset values and concerns that the entire global economic system may somehow be broken. Just as fast as the implications of these catastrophic events began to sink in, we were watching stock prices rise, and companies began to report much better-than-expected earnings. It’s no wonder the word “surreal” got thrown around so much during this time. “Surreal” according to the dictionary means “having a disorienting, hallucinatory quality of a dream; unreal; fantastic.” Those who felt that the bear market of 2008-2009 was a nightmare from which they would never awake, now wonder if the current bull market is equally ethereal, something that could vanish at the sound of the alarm clock.

Originally, “surreal” was more than an adjective. It was a fully-formed school of thought which was created in France during the 1920s and reached its apex in the 1930s. Although most people today might relate surrealism with the visual arts, its practitioners also explored its theme in literature, philosophy, theater, and even politics. The aim of surrealism in the visual arts was to strip ordinary objects from their normal significance and thus create a compelling image that was beyond any normal experience. The goal was to expose truth, or at least evoke some extraordinary feelings from the viewer by the display of these images.

Persistence of Memory

One of most well-known paintings from this era, “Persistence of Memory” by Salvadore Dali, illustrates this concept well.

In it we see a background comprised of cliffs and a seascape, captured realistically. Even the dead tree on the left side of the painting appears to be something one might see in real life. However, everything else in the frame underscores the disorienting nature of surrealism. We recognize the watches, but may be confused or even repelled by their melting or the swarm of ants covering the one in the lower left side. The strange shape in the middle covered by one of the melting watches has some human characteristics, but cannot be called human.

Regardless of whether or not one “gets” the painting, it no doubt evokes some kind of emotion from the viewer. Many have tried to explain the symbolism behind each component of the painting (which were often repeated in Dali’s works), but for our purposes here, let’s focus on the watches. By depicting the watches (which we usually consider solid, rigid and important – they keep us on schedule) in this soft fashion Dali is making a statement about time. That time may not be as important, fixed or deterministic as one might think. A bit of Einstein’s thesis on the relativity of time may be at work here as well.

These ideas feel radical and disorienting to us because we “know” time marches forward in clean and clear one second intervals. Of all the constants we can observe, time seems to be the most solid. Thanks to Einstein, we know that time can be variable and that our perceptions of events can be distorted by many factors, including our own memory.

Short Little Span of Attention

Someone once said, “My memory’s not as sharp as it used to be. Also, my memory’s not as sharp as it used to be.” Even when we can recall with clarity the events of the past, our ability to profitably use these recollections wavers from time to time. Think back to the dark days of the credit crunch in late 2008 or the market’s low point in March of 2009. Even though one may be able to conjure up some of the angst felt at that time, it’s more likely that these feelings have faded quietly into the past. Traumatic experiences like market crashes and recessions are somewhat like physical pain – we are acutely aware of the feelings as we experience them, but later we really cannot remember how it felt. We know that it hurt bad, but we cannot relive the pain as it was.

This is probably a necessary feature of our memory structure regarding physical pain, but not being to better recall and learn from traumatic events like crashes and bubbles, seems like a human frailty. When confronted with a new financial crisis, it seems that all recollection of the past flies away.

This may also be true as the crisis passes. Some of the pain of the past year can still be observed in the large amount of cash parked in low-yield money market funds and CDs, but much more of the daily commentary seems focused on how much higher the market can go rather than what lessons were learned from this crisis. George Santayana’s famous quote comes to mind here, “Those who cannot remember the past are condemned to repeat it.”

Pattern Recognition

One of the greatest benefits of personally experiencing many financial cycles is the ability to place the most recent circumstance into historical perspective. Even though each new crisis feels unique, worse than the previous one, and as if it will never end, they all generally follow a similar pattern. Ironically, they usually begin with euphoria. Investors become so enamored with an asset class (real estate, for example), that they begin to think of it as a “no risk” investment. Wide-spread euphoria will eventually create considerable imbalances, often characterized as bubbles. At some point, something will happen that identifies and then pops this bubble (like the collapse of Lehman Brothers). Then as investors scramble to sell these assets, pay off loans and seek the safety of more liquid assets, prices fall. In a severe crisis, the prices of nearly all assets fall, with correlation among assets moving close to 1.0 (effectively negating any benefit of a diversified portfolio). Falling prices will eventually correct the imbalances, but investors, because they are using the feeling or feral part of their brain (instead of the thinking part), may continue to sell long after the imbalances have disappeared. Markets often overshoot on the downside following a crisis. More often than not, we see the nadir of prices at the apex of fear.

The recovery periods after financial crises also follow a familiar pattern. As prices bottom out and the final marginal seller has placed his last order, the market is primed to recover. Usually the first uptick in prices is met by some additional selling, but eventually prices begin to recover. This most often occurs in the middle of the bad news. Looking at every single recession since 1933, we see that the stock market bottomed out in the middle of the recession. The bear market which ended in 2009 was no exception. The bulk of economic data in the first part of 2009 was unanimously bad, but the stock market moved higher anyway, just like it had in every other recession before. As stock prices rise, the debate intensifies as to whether this recovery is a new bull market or just a bear market rally. Investors who sold near the bottom are now faced with a dilemma – do they buy back at higher prices or wait for lower ones? In most cases, the lower prices never come. Eventually, the panic and pain felt during the crisis fade away and new feelings of euphoria emerge, and eventually the cycle starts all over again.

So what’s the point of all of this? We wish to impress upon our readers that our investment professionals have a great deal of experience and have personally lived through many bull and bear markets. Because we are professionals, we have also studied a great deal about panics, manias and crashes in other times and places. We understand the forces at work in the financial markets and on the human mind. One of the more valuable services we can provide our clients is this perspective.

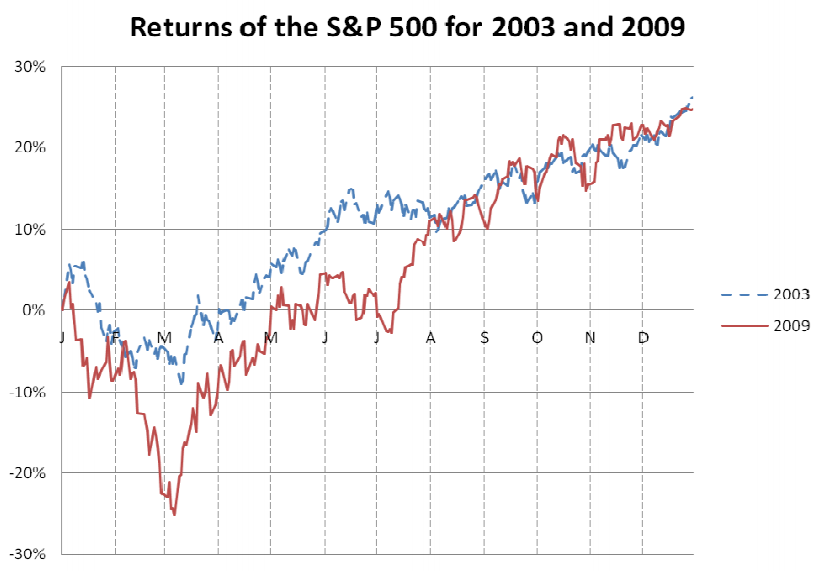

As the stock market fell in early 2009, we began to have this sense of déjà vu – a feeling that we’d seen this movie before. In our internal discussions, we concluded that the pattern of the market, the tone of the commentary and news spin of the events all reminded us of 2003. The fundamentals were quite different, but how things played out in the markets seemed similar. This gave us some confidence that the forces which affected the market in 2003 could reappear in 2009. Ultimately, the market is driven by money flows and sentiment, and that was highly evident in both 2003 and 2009. The chart below shows how similar the two years turn out to be.

Clearly not every year is going to look like another one. And just because someone has experienced past cycles does not automatically qualify that person to know what to do in every circumstance. Yet, having the ability to put the present into the context of the past is a powerful tool to aid one in understanding what’s going on right now.

The Outlook

We continue to believe that we have entered a new bull market. The average bull market lasts 51 months and can move the market up 100% or more from the bottom. Because we think we are still in the early stages of the bull market, worries about how it will end seem highly premature. It would be very unusual for the economy to falter at this point in the cycle.

Granted, the negatives for the market and the economy have not gone away. This too is typical and normal for the early stages of a recovery and a new bull market. Monetary stimulus will eventually end, as will fiscal stimulus. The US Government budget deficit is something that weighs on all investors. Many expect inflation to be a problem somewhere down the line.

We are aware of all these issues and they are important inputs into our investment decision making process. Our conclusions still support a bullish view of the equity market. We think that the large amount of cash on the sidelines is a fundamental which could overwhelm all others. The prospect of rising interest rates could also boost demand for stocks (investors would sell bonds and buy stocks). Through aggressive cost cutting over the last year or so, companies all around the world now possess operating models which are highly leveraged to sales growth. That is to say, a small amount of sales growth could yield a very large growth in earnings. This also could help the stock market.

We think 2010 could be a challenging year for the bond market. Many expect the accommodative monetary and fiscal policies of the US government to moderate, providing less support for bonds. In the face of nearly unanimous expectations for higher interest rates, we are not bullish on bonds. Yet, the timing of such a rise and its magnitude are highly uncertain, despite their being widely expected. Government bonds and high-grade corporate bonds appear to be overvalued. We continue to find some value in lower-quality (yet investment grade) corporate bonds, especially in the three- to seven-year maturity range. There are also pockets of value still available in the municipal bond market.

As we consider past patterns, we would note that during each previous bull market, we have seen sizable corrections of up to 10% somewhere along the bull market’s multi-year rise. We would not be surprised to see a correction this year. We suspect that when this happens, some of the commentary will suggest that the bull market is over, or was just a dream to begin with. At that moment, we hope to be able to pull from our basket of experience and memories something that will provide you with the perspective and comfort you may need.

Sincerely,

Wolf Group Capital Advisors