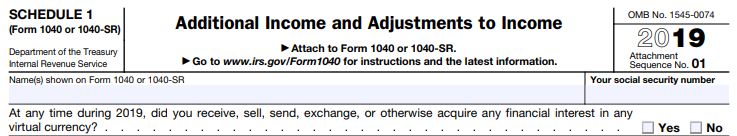

Most people are unaware that the IRS tends to “bury” high-stakes questions in individual tax returns. Yet a different approach could benefit and protect taxpayers. Did you even notice an additional question on the 2019 US Individual Income Tax Return (Form 1040)? The IRS recently introduced a “Yes or No” question related to virtual (crypto) currency on Schedule 1. It is listed at the top of the form and says, “At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” The response choice is either yes or no, and all tax software automatically presets the answer to “no.”

Why Is This an Issue?

The IRS includes a number of different informational questions on the tax return. The consequences for missing or incorrectly answering these questions can range from minimal to criminal. There are typically three categories of informational questions:

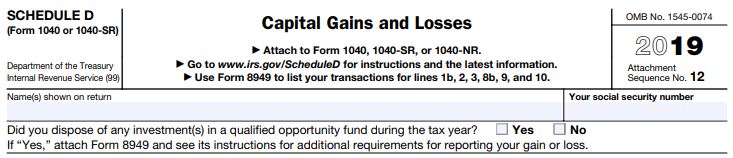

1. Some are benign or merely helpful for tracking. One example is the new question at the top of Schedule D for Qualified Opportunity Zones, “Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?”

2. Some questions can create income tax consequences if not appropriately answered. One example is all the new questions on the Schedule K-1.

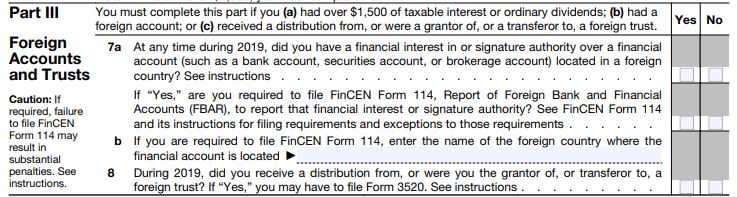

3. Other questions, if not appropriately answered, could create serious tax liability through civil and criminal penalties. One such example is found on Schedule B Part III, which includes two questions related to foreign bank accounts and financial asset reporting:

US citizens and residents who have an interest in, or signature authority over, a financial account in a foreign country with assets in excess of $10,000 are required to disclose the existence of such account on Schedule B, Part III, of their individual income tax returns. Failure to do so can be construed as “willful” behavior triggering the more significant penalty regime, as opposed to non-willful behavior, triggering lower civil penalties.

The new question on Schedule 1 related to cryptocurrency also falls in this category and could result in criminal charges or willful penalties. If taxpayers miss it or inadvertently leave it as the default “no” when they do indeed own cryptocurrency or have cryptocurrency transactions, then the IRS could later claim that they fraudulently or willfully hid their taxable income from cryptocurrency.

As you can see, these questions are hidden in the forms listed in small print and can be difficult for the layperson to interpret.

A more effective and just approach would be for the IRS to produce an independent informational schedule that has simple, straightforward questions, written in large bold font, with helpful explanations that do not default automatically to “no” on tax software. If the answers to these questions directly correspond to significant penalties and perhaps even criminal liability, then taxpayers must be forced to read through them in full and answer them affirmatively.

Here is our example of the questions that should be asked:

Schedule IQ (Informational Questions)

1. In 2019, did you have an interest in a foreign financial asset? Yes or No

a. Interest means direct ownership that is sole and separate, jointly with another individual or signature authority.

b. Foreign financial asset means non-US bank account, investment account, retirement account, cash value life insurance policy, or something similar.

2. If you answered yes to question 1, are you required to file FinCEN Form 114 (FBAR)? Yes or No

a. FinCEN Form 114 is required if the maximum value of your foreign financial assets on any given day during the calendar year exceeds $10,000 (USD) in the aggregate. Example – I have five (5) bank accounts in France, and each account has a maximum balance of $2,000 (USD) at one point during the calendar year. The maximum aggregate value of all five accounts is $10,000, and therefore you have an FBAR filing requirement.

3. If you answered yes, to question 1, are you required to file Form 8938 to report the maximum values of your foreign financial assets? Yes or No

a. Form 8938 requires the same reporting as FinCEN Form 114 and additional items such as offshore pensions, interests in foreign entities, and stocks and securities held directly, etc. Here are the filing thresholds:

i. Filing Status: Single

1. Aggregate Value at Year End: $50,000

2. Highest Aggregate Value at Any Time During the Year: $100,000

ii. Filing Status: Married Filing Joint

1. Aggregate Value at Year End: $100,000

2. Highest Aggregate Value at Any Time During the Year: $200,000

iii. Filing Status: Taxpayer Living Abroad (Single)

1. Aggregate Value at Year End: $200,000

2. Highest Aggregate Value at Any Time During the Year: $300,000

iv. Filing Status: Taxpayer Living Abroad (Married)

1. Aggregate Value at Year End: $400,000

2. Highest Aggregate Value at Any Time During the Year: $600,000

b. Please note that Form 8398 has other IRS International Informational Reports that tie in directly to the Form. Taxpayers are encouraged to review their facts and circumstances to determine if they are required to file these forms: 3520, 3520-A, 8865, 5471, 5472, 8621, 8992, 926, and 8858.

4. In 2019, did you have an interest in virtual or cryptocurrency? Yes or No

a. Interest means direct or indirect ownership in a virtual or paper wallet that stores private and public keys to virtual or cryptocurrency.

b. Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value. Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency is referred to as “convertible” virtual currency. Bitcoin is one example of a convertible virtual currency. Bitcoin can be digitally traded between users and can be purchased for, or exchanged into, US dollars, Euros, and other real or virtual currencies.

5. In 2019, did you have a virtual or cryptocurrency event? Yes or No

a. A virtual or cryptocurrency event could be one of the following:

i. Sale of virtual or cryptocurrency

ii. Exchange of one virtual or cryptocurrency for another

iii. Sending virtual or cryptocurrency to an individual or business for a good or service

iv. Acquire virtual or cryptocurrency from an exchange, individual, business, and/or initial coin offering

v. Mining of virtual or cryptocurrency

1. Cryptocurrency mining, or crypto mining, is a process in which transactions for various forms of cryptocurrency are verified and added to the blockchain digital ledger. This is also known as crypto coin mining, altcoin mining, or Bitcoin mining.

vi. Receive an airdrop, giveaway, or token from a hard fork transaction.

1. A hard fork occurs when a cryptocurrency undergoes a protocol change resulting in a permanent diversion from the legacy distributed ledger. This may result in the creation of a new cryptocurrency on a new distributed ledger in addition to the legacy cryptocurrency on the legacy distributed ledger.

6. If you answered yes to question 6, you might be required to report the virtual or cryptocurrency event on your Individual Income Tax Return.

7. In 2019, did you contribute either directly or indirectly to a foreign trust? Yes or No

8. In 2019, did loan money to a foreign trust? Yes or No

9. In 2019, did a foreign trust loan you money? Yes or No

10. In 2019, did you receive a distribution from a foreign trust? Yes or No

11. In 2019, were you the owner of a self-directed foreign pension plan similar to a US Individual Retirement Account? Yes or No

12. If you answered yes to questions 7, 8, 9, 10, or 11, you might be required to file IRS Forms 3520 and/or 3520-A.

WARNING: The answers to the questions should be taken very seriously by all taxpayers. Failure to provide true, accurate, and correct responses could result in significant civil penalties starting at $10,000 per offense up to criminal penalties that could result in incarceration or jail.

There are likely several ways to style the schedule to make it easily readable. The online software companies could also add helpful hints along with links to websites throughout for individuals who want more explanation and understanding.

Summary

If the goal of the IRS to obtain this information through voluntary annual compliance, then the current method that is being used on Schedule 1 and Schedule B is simply not adequate, nor is it helpful. The IRS should take proactive steps to redesign this approach into a more user-friendly format with readability for laypersons.

The Wolf Group has been representing individuals, estates, and businesses with IRS amnesty programs and international informational reporting for decades. If you have questions about prior- or current-year compliance issues related to a foreign financial asset or cryptocurrency reporting, please contact us directly for a discovery call or Zoom meeting.