“Dow Jones Hits 17,000 for the First Time after Strong Jobs Report.” Thus screamed the headlines on July 3rd of this year. Whenever the market hits a new high and passes a nice, fat, round number like 17,000, everyone seems to think it is a big deal. The number of articles about the market seems to skyrocket in times like these. Market “gurus” appear, as if out of nowhere, to weigh in on what this development means for the future. For every one of them suggesting that this new high is a precursor for even higher highs, there is another one telling investors to take profits and buckle down for the next crash. Truth is, no one really knows about the future of the market.

Another truth is that the market (if one uses the broader S&P 500 Index) has been hitting new highs for over a year now. Given that the U.S. equity markets ALWAYS moves higher over time, new highs should not be surprising. We have actually seen 106 new highs for the S&P 500 since 2013. Only if one were still focused on the once-in-ageneration financial crisis of 2008-2009 would new highs in the market be either surprising or worrisome. So if listening to “gurus” and noting new highs in the market are not very helpful in understanding how to invest, what does the professional investor do to make money in the market? Glad you asked. We offer some ideas after the second quarter review…

Second Quarter Review

Almost everything moved higher in the quarter. Despite considerable concerns over oil prices, geopolitical conflicts, domestic political scandals, etc., nearly every asset class posted positive returns. With better economic news from Europe and less concern about the banking industry in the Eurozone, the 12-month performance of those markets nearly mirrors the U.S. indices. Despite some residual pockets of worry (Russia, Argentina, etc.), even the emerging market (EM) economies are posting marginally better economic data. Although the EM equity markets showed solid Q2 performance, they continue to lag the U.S. indices. The one highly puzzling data point reported in second quarter was the U.S. GDP final revision for the first quarter, coming in at -2.9%. This was the weakest quarterly GDP number outside of a recession for many decades. The markets did not seem to care about this surprisingly weak showing, yet some people may wonder why the U.S. economy was so weak in Q1. Bad weather was one factor, but the more important ones were 1) a dramatic cutback in inventories, 2) weak trade figures, 3) some strange accounting for healthcare linked to the Affordable Healthcare Act. All credible economists are expecting a resumption to trend GDP (2.5- 3.0%) in Q2 and beyond, but be advised that the healthcare accounting issues could linger (and hurt perceived economic activity) in Q2 and possibly beyond.

Here is what the second quarter looked like by the numbers:

| Index | 2nd Qtr 2014 | Year to Date | Trailing 12 Months |

|---|---|---|---|

| Dow Jones Industrial Average | 2.8% | 2.7% | 15.6% |

| S&P 500 | 5.2% | 7.1% | 24.6% |

| NASDAQ | 5.0% | 5.5% | 29.5% |

| Russell 2000 | 2.1% | 3.2% | 23.6% |

| MSCI EAFE | 4.1% | 4.8% | 23.6% |

| MSCI EAFE Small Cap | 2.5% | 5.0% | 29.3% |

| MSCI Emerging Markets | 5.6% | 4.8% | 11.8% |

| Barclays Aggregate Bond | 2.0% | 3.9% | 4.4% |

| Barclays Municipal Bond | 2.6% | 6.0% | 6.1% |

| Dow Jones Commodities | 0.0% | 7.3% | 8.1% |

What is Investing?

Sometimes it is helpful to strip down a complex function (like investing) into its elemental parts. According to Merriam-Webster, “Invest” (from the Latin root meaning “to clothe”) is “to commit (money) in order to earn financial return.” From this simple starting point, we may then consider the various methods of investing. One can directly invest in a business by buying the entire operation – something that Berkshire Hathaway has done quite successfully over the years. One can invest by purchasing financial assets (like stocks and bonds) via a trading exchange. Mutual funds and hedge funds are two other important means of committing money in order to earn a financial return.

If one wishes to invest in stocks, one must decide on an investment style or philosophy. Here too the choices are numerous. Growth, value, active trading, quantitative, technical, passive, etc. are all valid and historically successful approaches to equity investing. Given our penchant for value investing, let us drill down a little more on this style of investing. At its heart, value investing is simply buying something that trades below its “real,” “fair” or “intrinsic” value with the expectation that it will one day trade at or above this value.

Many of the most successful investors in history, including Warren Buffett, Benjamin Graham, Sir John Templeton, John Neff, et al., were value investors. Perhaps less famous (but equally successful) is Seth Klarman, who started his Blaupost hedge fund in 1982. Blaupost is now one of the largest hedge funds in the country and boasts a phenomenal track record of 19% annual returns from then until now. Notorious for his cautiousness, he rarely invests 100% of his fund in stocks. Still, when he buys stocks, he seeks those trading at some huge discount to intrinsic value.

In a recent Institutional Investor magazine article, Mr. Klarman answered the question, “Is investing an art or a science or a craft?” His answer (perhaps typical for a value investor) was, “I would say art first and foremost, craft second, science third.” This answer may surprise most people, but rings true to the value investor.

Science

“Science” (from Latin meaning “to split”) is “knowledge or a system of knowledge covering general truths or the operation of general laws especially as obtained and tested through scientific method.” We can trace the science of investing back to the 1930s. Before then, investors (speculators, really) made decisions based on emotion, rumors and insider information. Benjamin Graham may have been the first to understand that stock prices should respond to a set of general laws. Today, all professional investors understand the ratios, valuation methods, and other metrics that drive stock prices. Some investors such as high-frequency traders and other “quants” employ highly sophisticated computer models to gain an edge in their trading techniques. Yet, none of this “science” alone can identify with certainty a value stock, or help one make money in the markets. Mr. Klarman goes as far as calling the “science” part of the value investing equation a “commodity.” Because most investors understand these general laws, it is nearly impossible to gain an edge on pure science alone.

Here at Wolf Group Capital Advisors, the “science” of our investment process begins with quantitative screens. We use a series of data screens to identify stocks that may be trading below their fair value. We do not rely on Wall Street analysts or stockbrokers for any of our ideas. We find that these screens with their unemotional approach to stocks (“just the data, ma’am”) provide us with a great starting point. The second “science” we use is a comprehensive printout of financial ratios and history, time series, earnings estimates, valuation metrics and so forth. We find that we can learn almost all we need to know from nine special spreadsheets containing the above data. Although none of this “science” is exactly proprietary (hence, Mr. Klarman’s notion of it being somewhat of a commodity), we think we employ our science in a unique and intelligent way.

Craft

“Craft” (from the Old High German meaning “strength”) is “a job or activity that requires special skill.” In Mr. Klarman’s view, “craft” (as it applies to value investing) is “showing up every day.” Because two of the keys to success in value investing are being disciplined and not overpaying, the skill of “showing up every day” cannot be underestimated. The average daily activities of a value investor probably have very little to do with the Wall Street image portrayed in Hollywood movies. Reading annual reports, studying SEC filings and visiting company factories may have little sex appeal, but they are the foundation of “showing up” every day.

Here at the Wolf Group Capital Advisors, the “craft” of our investment process has two main components. First is the report we write when bringing a new idea to the Investment Policy Committee. Using the nine spreadsheets and a few other resources, we can distill the pertinent investment considerations of a stock onto one page. We then discuss the merits of each new idea in our committee and decide whether to add the new stock to our Buy List. The second part of our “craft” is monitoring the fundamentals of each name on our Buy List. This somewhat tedious part of our craft is necessary to assure that all of the names on the list are still fundamentally sound and still offer an attractive investment return for our clients. No sex appeal here either, but this continuous effort provides our advisors with the confidence of knowing that our client portfolios ever represent our “best efforts.”

Art

“Art” (from the Latin meaning “art”) is “something that is created with imagination and skill that is beautiful or that expresses important ideas or feelings.” “Nothing is as beautiful as a well-balanced equity portfolio,” said no one, ever. Yet, the importance of art in the value investor’s toolbox reigns supreme. Mr. Klarman defines the investment art as “the ability to distill two or three major themes out of an investment and get right to the heart of the matter.” After all the numbers have been crunched, all the research completed and all the pros and cons of an investment have been thoroughly discussed, there comes a key moment where the investor becomes the artist. The decision to buy a security requires a bold step into the darkness of uncertainty. Investing in a stock is never a “sure thing.” The complexity and dynamism of the investment process will likely always prevent it from becoming something anyone can do successfully in their spare time.

Here at Wolf Group Capital Advisors, our “art” is on display at our weekly Investment Policy Committee meetings. After we fully review the numbers and the investment thesis, engage in a discussion about the stock, and ask tons of questions, we reach a point where we need to decide “yay” or “nay” on the idea. All of our IPC decisions must be unanimous. Sometimes we pass on a stock whose only attractive trait is valuation. Some stocks are cheap for good reasons. Sometimes we like the potential return of a stock, but deem it to volatile or “risky” for our client portfolios. Regardless of the outcome, we make our decisions using the full measure of our experience as investment professionals and calling upon whatever artistic talents we possess to find confidence in the new idea. Over our years of working together, we have developed the ability to get to the heart of a new stock efficiently and so far successfully.

The Outlook

Every time the market falls 2-3%, there is an immediate and often hysterical warning cry that a correction, collapse or crash is imminent. We view this as a healthy sign that the bull market in stocks can continue. Bull markets usually end in a state of investor euphoria, a condition where everyone thinks stocks are not only the only game in town, but are a “can’t lose” proposition. In this condition of euphoria, one would almost never hear talk of a crash, and investors would view a market decline of any size as universally good news. We do not think we are there yet.

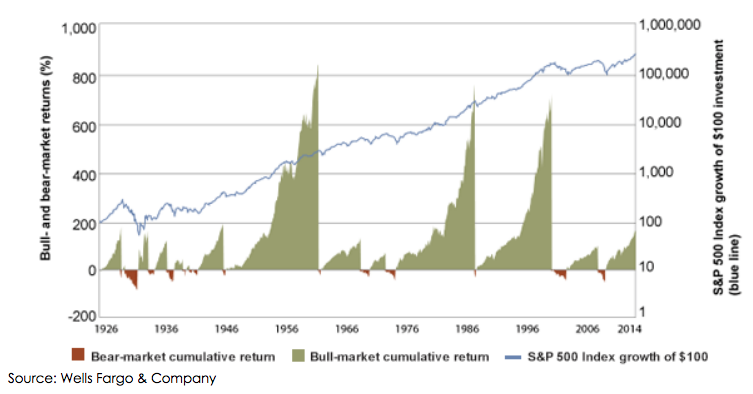

Other positives for stocks would include 1) modest valuations (stocks are extremely undervalued relative to cash and bonds), 2) tons of cash on the sidelines, accommodative monetary policy, improving economies nearly everywhere in the world and solid earnings growth. We would also note that bull markets historically have lasted much longer than bear markets, as shown in the chart below. As shown here, returns accumulated in bull markets dramatically outpace the losses sustained in bear markets.

The bond market situation is more complicated. As of this writing, the U.S. Treasury 10- year note yields 2.5%. Historically, this level of interest rates would suggest the economy is in recession and an easy monetary policy was being used to jumpstart it! Five years into the economic recovery (the recession ended in 2009, as you may recall), this level of interest rates is surprising. The unemployment rate has fallen to 6.1%, and inflation is running about 2% annually. Both of these numbers are close to the Federal Reserve’s targets for becoming less accommodative.

If there is one non-consensus worry out there, it is that either the U.S. economy and/or inflation will be stronger than the Fed currently expects. This could accelerate the timing of Fed policy becoming tighter. Right now, the consensus expects the Fed to raise the Fed Funds rate in mid-2015. Moving that expectation forward could have negative implications for the bond market.

The good news here is that stocks should outperform bonds and cash in this environment. Many good reasons for holding bonds still exist, but if there are surprises over the next few quarters, they might be bond market related. A correction in the stock market (defined as a price drop of up to 10%) would not be a surprise, in our opinion. We continue to think that cash (beyond some reasonable “rainy day” reserve) is the worst asset for investors to hold.

Sincerely,

Wolf Group Capital Advisors