“If we had no winter, the spring would not be so pleasant; if we did not sometimes taste of adversity, prosperity would not be so welcome.” – Anne Bradstreet

Is springtime everyone’s favorite season? There is something refreshing and reassuring in seeing new buds on the trees and the green color returning to our lawns. Metaphysically, the spring ushers in new feelings of rebirth and recommitment; a shaking off of the dark, cold things of winter and embracing all the fresh, colorful and cheerful things this new season offers. The stock market surely did not pause in its upward march just because of the winter cold. In fact, there seems to be little that can stop this new bull market. The big news items of late (troubles in the Middle East and the disasters in Japan) caused nothing more than minor blips in the market’s upward trajectory. Yet, as we stroll through these pleasant pastoral fields, do we see some mysterious smoke on the horizon? What is that industrial clanking sound beneath our feet? Are there Morlocks waiting in the wings poised to disrupt our capital markets feast?

First Quarter Review

For the quarter, the S&P 500 rose 5.9%. This was the best performance for the first quarter of a calendar year since 1998. Given the negative sentiment which seems still lingering in this country, this positive performance may be puzzling to some. The simple answer is that the stock market is merely reflecting the strong underlying fundamentals of the current business cycle. The economy is growing, but more importantly so are corporate earnings. The crises of the day, be it Greece, Portugal, Libya or Japan, may dampen investor sentiment for a short period of time, but ultimately the market cares more about fundamentals, which continue to be strong. Consider that when the earthquake and tsunami hit Japan in early March, the market quickly fell over 3%, but within nine trading days was back to where it was before the crisis began.

Bond market returns were very modest in the first quarter. Yields are starting to rise, and we have begun to see mutual fund flows away from bonds and cautiously into stocks. The Federal Reserve’s commitment to keep pumping money into the system is likely to keep short rates about where they are for a while, but we can expect interest rates all along the yield curve to rise over the longer term. Yet, we see no reason for bond investors to worry. Despite the possibility of higher rates, fixed income securities still perform a valuable service to investors unwilling to fully embrace the volatility of the stock market.

Here’s what the first quarter looked like by the numbers:

| Index | 1st Qtr 2011 | Year to Date | Trailing 12 Months |

|---|---|---|---|

| Dow Jones Industrial Average | 7.0% | 7.0% | 15.9% |

| S&P 500 | 5.9% | 5.9% | 15.1% |

| NASDAQ | 5.0% | 5.0% | 16.6% |

| Russell 2000 | 7.9% | 7.9% | 25.4% |

| MSCI EAFE | 3.8% | 3.8% | 9.7% |

| MSCI EAFE Small Cap | 3.4% | 3.4% | 18.7% |

| MSCI Emerging Markets | 2.5% | 2.5% | 16.9% |

| Barclays Aggregate Bond | 0.3% | 0.3% | 4.3% |

| Barclays Municipal Bond | 2.6% | 2.6% | 0.4% |

| Dow Jones Commodities | 4.5% | 4.5% | 28.8% |

We Live in the Future

Every now and then, one should pause for a moment and reflect on the technological advances we humans have made in the last few decades. The march of technology is relentless and yet, in many ways, subtle. Although some advances in technology are epoch-defining, such as the combustion engine or the personal computer, many others occur at the periphery of our consciousness, and only much later do we comprehend or appreciate their true worth.

Technological advances not only occur in the laboratory, but also in the minds of creative writers. Science fiction has been a popular genre for many decades. There is something within us that finds depictions of the future fascinating. At times, the authors get it right – manned space flight, for example. Sometimes they fail – where are those flying cars anyway? An interesting interplay exists between science fiction and science achievement. At one level, if a person could imagine it (the iPod, for example), they could have invented it. On the other hand, an author’s fantastic notions have no doubt inspired and motivated some scientists to consider their actual possibilities. Can warp engines really enable space travel? Could a flux capacitor make time travel a reality?

Do Androids Dream of Electric Sheep?

Yet for all the hope and optimism one may have for how technology can bring new things to life, there is a dark side of scientific advancement that often captures the imagination of sci-fi writers. Hollywood is no stranger to the dystopian visions found in these novels, and has created many blockbuster movies based on this theme. The Terminator, The Matrix, 2001: A Space Odyssey, The Time Machine, and Blade Runner are but a few examples of this idea. The idea is this – humans, in our quest for a better life, can become overly reliant on technology, or may invent machines which become sentient and this ultimately can lead to the machines either taking over the human race or at least declaring war on their creators.

Is it possible that we are already too reliant on technology? How many of us know how to program the computer that runs our car engine? What happens to our young people when their cell phone service is disrupted? We saw a vivid example of this in Egypt during the recent conflict there when the government reportedly “turned off the Internet” in an attempt to restrict the flow of information. Even that most marvelous miracle – the harnessing of the energy of the atom has been called into question following the troubles at Japan’s nuclear power plants. So technology can be a clear benefit to humankind, but knowing how much is too much and how far is too far remains a challenge.

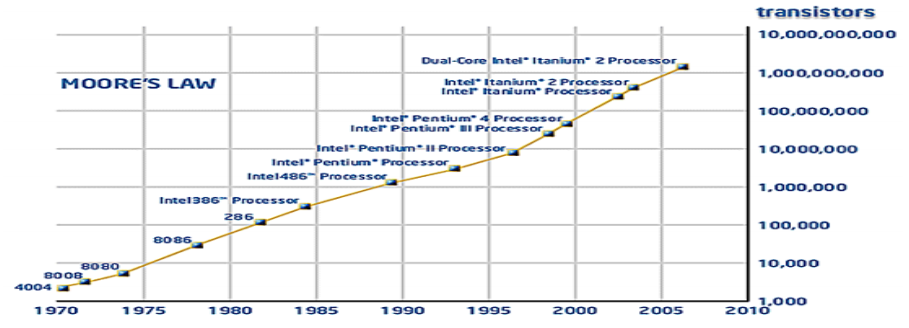

Bigger, Faster, Better? The pace of technological change is unlike anything else we experience. Take Moore’s law for example. Moore’s law suggests that the density of transistors on an integrated circuit doubles roughly every two years. This means that computer speeds, digital memory capacity, and even the number of pixels in digital cameras double at an amazing rate. Intel co-founder Gordon Moore (who identified this law) put the computer industry’s quantum evolution into comparative terms when he declared: “If the automobile industry had advanced as rapidly as the semiconductor industry, a Rolls Royce would get 500,000 miles to the gallon and would be cheaper to throw away than to park.” As seen below, Moore’s law has been actualized for over forty years.

Hi-def television, streaming video via the Internet, on-demand digital movies, iPods, iPads and even the high-tech camera lenses on one’s cell phone all come as a direct result of this phenomenon. Some of the grumpier commentators note that much of this fantastic new technology is used in mostly inane ways such as watching television, playing Facebook games and reading or posting “Tweets.” Try as we may, technology cannot make us smarter, wiser or help us to get along better with each other.

The Computer Comes to Wall Street Decades ago trading on Wall Street was simple – one called a broker, who called his trader, who called the firm’s floor trader, who spoke to the market maker to execute the trade. Phone calls and paper tickets were the norm. Not that this lack of technology mattered to the average person – most people never owned stocks before the 1970s. As technology improved, so did the speed at which trades were made and communicated. Now we are able to see real-time quotes on any personal computer and execute trades within seconds.

Not only have computers changed how trades are executed and communicated, they have altered how some investors actually approach the market. As the cost of computing power fell, the economics of having massive calculating muscle behind one’s investment strategy improved dramatically. So-called “quant shops” such as D.E. Shaw, Renaissance Technologies and Barra, have used technology and an army of math Ph.D.s to construct models which help them beat the market. These investors approach the investing process very differently than do fundamental investors. They don’t visit companies, listen to corporate earnings calls, or care about what Wall Street analysts are saying. They only care about the numbers, and the correlations among investable assets.

Another innovative trading technique, which is purely technology-based, is algorithmic trading. This is the use of computer programs for entering trades with the computer itself deciding such things as timing, price or quantity based on some special formulas. In many cases, these orders will be initiated without human intervention. The goal is to quickly capture small bits of profits available due to inefficiencies in the market. A special class of algorithmic trading is called “high-frequency trading” (“HFT”). This method of trading also seeks to exploit tiny inefficiencies in the market, but computers using this approach may execute a number of trades in less than a second! Some people think that HFT improves market liquidity, lowers the cost of trading and improves the quality of information contained in a stock quote.

As with other technological advancements, there is a dark side to this kind of innovation. Since all of these smart people are trying to the same thing with similar tools, sometimes they all end doing the same thing. In August of 2007, the market was hit by a wave of selling by a group of quant funds all using the same trading strategies. This led to terrible losses and more selling by these funds – all trying to sell the same securities. This was the market equivalent of yelling “fire” in a crowded theater. Some estimates put the losses by the funds at nearly $100 billion, in just a one-week period.

In May of 2010, the Dow Jones Industrial Average fell 900 points (about 9%) only to recover those losses within minutes. The fundamental reason for weakness in the market that day was ostensibly concerns over the financial stability of Greece. Although it was not clear exactly happened that day, a full report by the Securities and Exchange Commission fingered HFT and other algorithmic traders as the main culprits. This event shook investor confidence, which was still smarting from the global financial crisis and bear market. Some began to wonder if the market was somehow “broken.” One real concern expressed by many is that too much money is being invested via intelligent, yet unthinking computer models. Nassim Taleb (author of The Black Swan) worries that these investors’ overreliance on computers gives them excessive confidence and blinds them to the possibility of seemingly rare economic catastrophes. Do they, in their heart of hearts, believe that the complexity of the markets can be fully captured in mathematics and models? If so, are they marching on the same dangerous path depicted in so many sci-fi novels?

The Age of Reason

Are the markets rigged against the little guy? We think not. There are many, many ways to invest and all of them can be successful. We don’t use massive computing power in our approach. We don’t feel disadvantaged compared with any larger investors. Part of this is due to our clients’ unique needs and wants. Another part of this is due to our market experience. The members of our Investment Policy Committee collectively have over 75 years of investment experience. We have personally experienced many business and market cycles, and we have extensively researched many more. We also know how to analyze stocks and bonds. We know how to measure value. We know what we know, and that we don’t know everything.

Information is not knowledge. Nor is knowledge wisdom. The ability to reason will always set humankind apart from the machines we create. Investment managers who can use the full quiver of investment tools and approaches will be able to achieve superior results. Trading faster does not always mean investing better. We also believe in something innate and intangible that exists within us, but will never be part of a machine – intuition. Given the complexity and uncertainty inherent in the markets, we often lack the clarity of vision we would like to have. Yet, once and a while, we can see something, or better put, feel something with such certainty that it moves us to action. We think this is one thing that will always put us ahead of any machine, no matter how smart it may seem.

We love technology. We do not fear the prospects of more innovation to come. As long as there are two sides a trade (a buyer and a seller), we think the markets will be a dynamic, profitable and important part of our economy, and a boon to our clients.

The Outlook

We see nothing in the near-future that could change our generally positive views on the U.S. and global economies and the U.S. stock market. World economies are growing, and most forecasts are calling for 2011 to be at least as strong as 2010. Corporations are flush with cash. As we have mentioned before, there are five things companies can do with this cash: raise dividends, buy back stock, buy each other, increase capital spending, or hire new workers. We have seen clear evidence of stock repurchase and dividend increases. Merger activity continues to be very strong, with the acquiring company usually using cash or debt to affect the takeover. These types of activities provide the stock market with a nice tailwind.

With unit labor cost in the U.S. still falling, we suspect that 2011 will be another good year for corporate earnings growth. The consensus for 2011 is for EPS to grow at least 10%. Like it or not, the Federal Reserve’s easy money policy is a big positive for the stock market. Very few pundits see the Fed raising rates anytime soon. Despite the recent price increases in food and oil, system-wide inflation remains in check. Investor sentiment, especially at the retail level, remains cautious. The market’s valuation remains at the low end of historical ranges. All of these elements suggest to us that the bull market in equities could continue. In many ways, this bull market is very typical: it began in the middle of a recession, it bottomed out at the peak of negative sentiment, it rose on the back of skepticism, it has been fueled by fundamentals not “concepts” and it has persisted despite new negative developments. If it continues to display this “normal” behavior, we could see it lasting at another year or two.

Sincerely,

Wolf Group Capital Advisors